At lukke en virksomhed på Malta indebærer mere end bare at gå sin vej. Hvert år ser Malta over 3.000 nye virksomheder stiftet- et vidnesbyrd om det indbydende forretningsmiljø. Hurtige etableringstider, lave adgangsbarrierer og engelsktalende institutioner gør øen til et attraktivt sted at... få din virksomhed i gang.

Men Ikke alle forretninger går godt. Hvis du står over for denne virkelighed, er du ikke alene. Rundt omkring 1.521 gik i frivillig likvidation i 2023, og den Maltas virksomhedsregister MBR slog en anden af 2.658 nedlagte virksomheder.

Måske fik din virksomhed aldrig fodfæste. Måske ændrede markedet sig. Eller måske har du bare mistet modet. Denne guide er til, når det er tid til at trække sig tilbage: elegant, ansvarligt og uden at gøre en smertefuld situation værre. Fordi At lukke en virksomhed er ikke en fiasko, men at lukke den forkert kan være det.især når det medfører undgåelige omkostninger, juridisk risiko eller fremtidige komplikationer.

Først og fremmest: Forsvind ikke

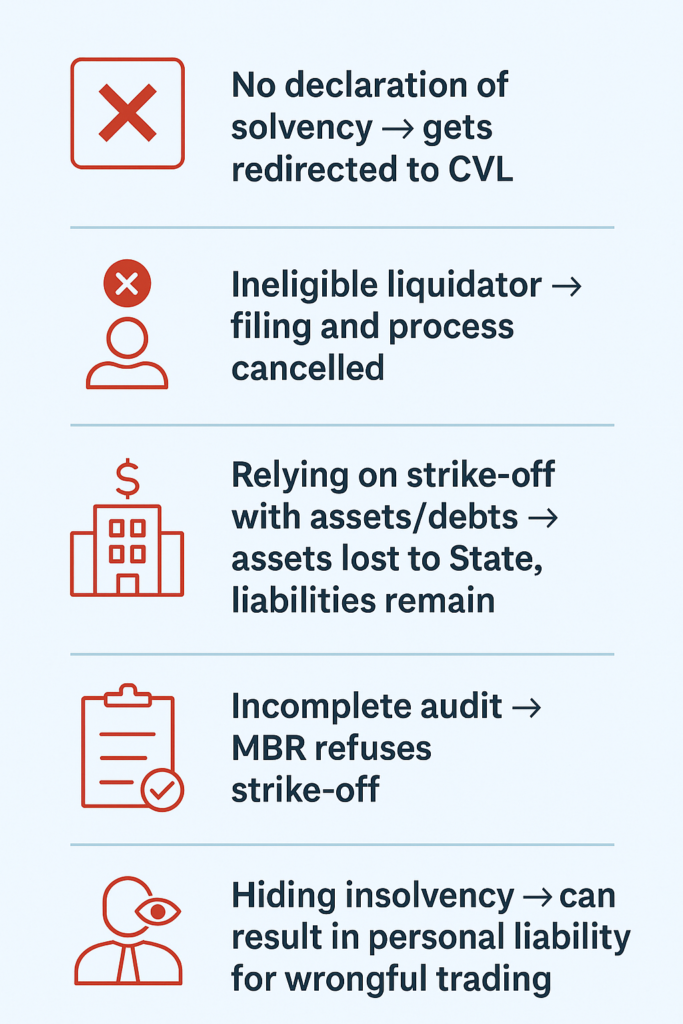

Det kan være fristende bare at stoppe med at handle og ignorere e-mails. Men virksomheder opløses ikke af sig selv. Og de MBR glemmer det ikke.

Hvis man lader en virksomhed hænge, vil MBR'en til sidst markere den som nedlagt. En offentlig meddelelse følger, og efter 3 måneders stilhed får din virksomhed slettet af registret.

Det lyder enkelt. Men det er det ikke.

- Alle virksomhedens aktiver, ja, selv den slumrende bankkonto er lovligt konfiskeret til staten.

- Du kan forblive personligt ansvarlig for ubetalte skatter, bøder eller indberetninger.

- Og kreditorer kan stadig trække dig (og din virksomhed) tilbage i retten op til 5 år senereog ansøger om at få virksomheden genoprettet. Det er en masse potentielle søvnløse nætter.

Kort sagt: At forsvinde afslutter ikke historien. Det flytter bare handlingen ind i en retssal.

Hvordan kan du lukke din virksomhed på Malta?

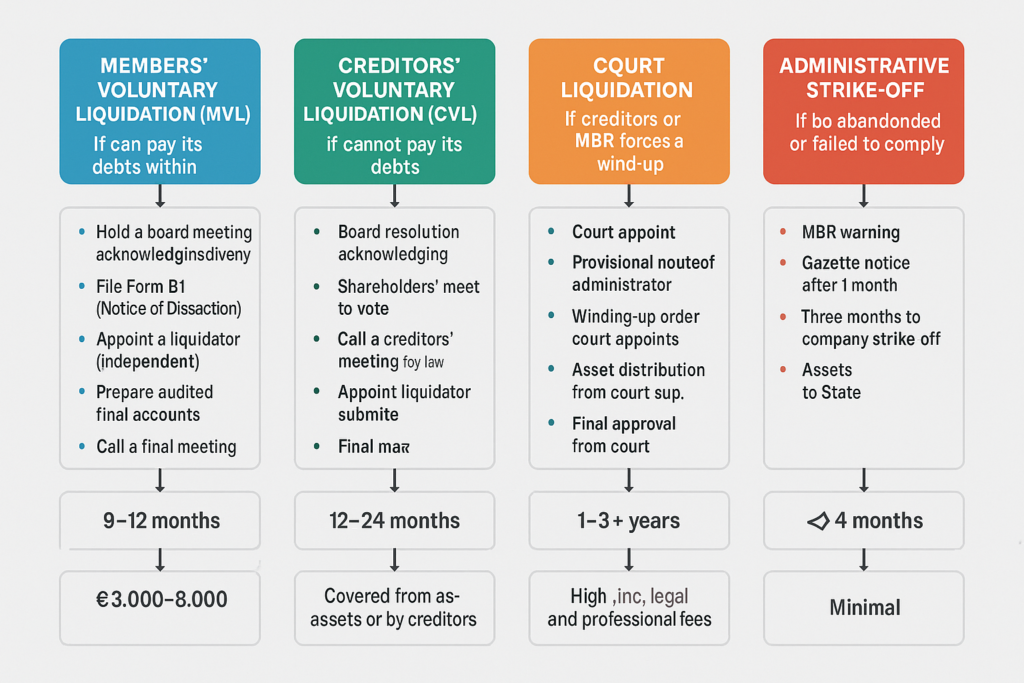

Der er fire lovlige måder at lukke en maltesisk virksomhed på. Den bedste vej afhænger af et enkelt spørgsmål: Kan du betale din gæld inden for de næste 12 måneder?

Hvis svaret er ja, er du solvent. Hvis ikke, er du insolvent - og så skal du træde varsomt.

Lad os udforske de fire hovedruter

1. Medlemmernes frivillige afvikling (MVL)

Bruges, når virksomheden er solvent, og du proaktivt afvikler den. Det involverer en formel beslutning, en edsvoren erklæring fra direktørerne og udnævnelse af en autoriseret likvidator. Hvis alt er i orden, kan det være overstået inden for 9-12 måneder.

Forvent at betale mellem €3,000-€8,000afhængigt af kompleksiteten af din økonomi og likvidatorens honorar (ifølge PwC Maltas estimater).

2. Frivillig likvidation af kreditorer (CVL)

Dette er for virksomheder, der ikke kan betale deres gæld. Aktionærerne indleder stadig processen, men kreditorerne inddrages tidligt og får lov til at vælge kurator. Det er en længere og mere struktureret proces, som normalt tager 12-24 månederog kan være mere følelsesmæssigt udfordrende. MBR rapporterede, at 809 virksomheder gik i frivillig likvidation i 2024.

Det positive er, at den maltesiske stat afsætter midler til at hjælpe med en velordnet, frivillig afvikling af insolvente virksomheder. Du skal ansøge i retten for at få dette til at ske (så realistisk set vil du være mindst flere hundrede euro ude af lommen, mens dette sker). Den anden gode nyhed er, at hvis din ansøgning bliver godkendt, vil afviklingen blive betalt af retten selv.

3. Retslig afvikling

Den indledes af en tredjepart, som regel en kreditor eller selskabsregistret. Det er den mest formelle og langsommeste proces, med Civilretten (handelsafdelingen) at holde øje med det hele. Juridiske og professionelle gebyrer kan hurtigt overstige €10,000og tidslinjen kan strække sig over flere år.

Retslig afvikling er sjældent nogens førstevalg, men den findes for at beskytte interessenter, når andre ikke handler ansvarligt.

4. MBR-strejke

Hvis din virksomhed holder op med at indsende papirer og ikke overholder reglerne, kan MBR tage sagen i egen hånd. Efter behørig varsel vil den slette virksomheden administrativt.

Det er hurtigt (ca. 4 måneder). Det er billigt (næsten ingen omkostninger). Og det er farligt, hvis det håndteres forkert - for hvis din virksomhed ejer noget som helstså mister du dem. Og hvis nogen har penge til gode, Du kan stadig ende i retten.. Realistisk set skal bestyrelsesmedlemmer og aktionærer have været væk fra radaren i et stykke tid for at nå dertil, hvilket (igen) betyder mange søvnløse nætter, civilretligt ansvar og potentielt strafferetligt ansvar i tilfælde af bedrageri og/eller grov uagtsomhed.

Trin for trin: Korrekt lukning af en virksomhed

Lad os sige, at du har taget beslutningen. Og hvad så nu?

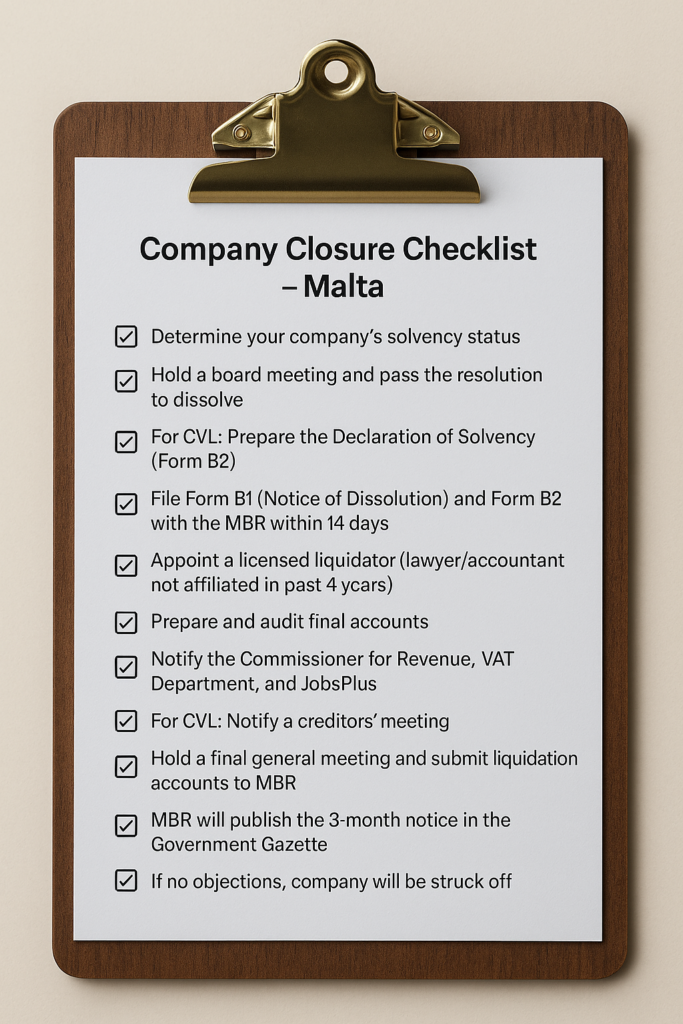

Opløsningsmiddel? Sådan gør du.

- Start med at holde et bestyrelsesmøde og vedtage en beslutning om afvikling. Inden for 14 dage skal du indsende Formular B1 (meddelelse om opløsning) og Formular B2 (Solvenserklæring) med Maltas virksomhedsregister (MBR). Du skal også indsende Form L at udpege en autoriseret likvidator - typisk en advokat eller revisor, der er registreret på Malta, og ikke en person, der har fungeret som direktør eller sekretær inden for de sidste fire år.

- Det endelige regnskab skal udarbejdes og revideres af en uafhængig revisor. Disse skal sammen med revisors rapport, Plan for distributionog likvidators afkastskal indsendes. Hvis likvidatoren fratræder, eller processen er i gang, Formular L3 (opsigelse) og Formular L4 (erklæring om afventende afvikling) anvende.

- Alle relevante myndigheder.Kommissær for skat, momsafdeling og JobsPlus-skal også underrettes.

- Når kreditorerne er betalt, og aktiverne er fordelt, kan en afsluttende generalforsamling er afholdt. MBR udgiver derefter en tre måneders varsel i Statstidendeog hvis det ikke bestrides, slettes virksomheden af registret.

- Vigtig bemærkning: Fra og med 1. marts 2025alle disse dokumenter - uanset om de er under Selskabsloven eller Regler for handelsskibsfart (herunder Formularer S, P, T, Q) - skal indsendes udelukkende via MBR's BAROS-system (Business Automation Registry Online System). Dette skift er en del af MBR's bestræbelser på at blive helt papirløse, forbedre effektiviteten og reducere administrative fejl.

Husk på det: Denne proces tager 9-12 måneder.og forsinkelser kommer normalt fra ufuldstændige optegnelser eller revisionsfejl. MBR rapporterede i juli 2025, at mediantiden for en virksomhed til at blive slettet var 1 år.

Insolvent? Sådan håndterer du det

- Anerkend virkeligheden. Hold et bestyrelsesmøde, og skriv ned, at virksomheden er insolvent.

- Vedtag en beslutning om likvidation, og underret dine kreditorer.

- A Kreditormøde skal afholdes, hvor kreditorerne stemmer om, hvem der skal være likvidator.

- Derfra styrer likvidatoren alt: fra salg af aktiver til håndtering af juridiske krav.

- Når gælden er betalt (eller afskrevet, hvis der ikke er nogen penge), aflægges det endelige regnskab, og virksomheden opløses.

Hvis du springer kreditorerne over eller forsøger at skjule insolvens som solvens, risikerer du Strafferetligt ansvar for ulovlig handel.

Hvad MBR og MFSA gør, når en virksomhed lukker

MBR

- Behandler alle ansøgninger, markerer nedlagte virksomheder, overvåger afviklingsprocessen via Insolvensregistret

- Udpeger den officielle modtager hvor det er nødvendigt

- Håndhæver overholdelse (sendte 1.186 endelige advarselsbreve i 2023)

- Gennemfører audits og inspektioner-3.800 slettede virksomheder alene i 2022

MFSA

- Træder til, når en reguleret enhed (bank, forsikring, fond) lukker ned

- Gennemgår og skal muligvis godkende likvidationen

Fem almindelige fejl, der kan afspore din virksomhedslukning på Malta

Få professionel hjælp

Selv om du kan klare en del af papirarbejdet selv på Malta, er en virksomhedsafvikling ikke et område, hvor du kan gøre det selv. Du skal have hjælp fra professionelle: en advokat, en revisor og en likvidator.

Det forventes ikke, at du er ekspert i afvikling af virksomheder. Men det forventes, at du handle ansvarligt.

GB Legal, blandt andre, håndterer regelmæssigt likvidationer for små virksomheder. De kan lede dig gennem alt fra udarbejdelse af beslutninger til endelig indgivelse af ansøgninger og sikre, at du er beskyttet.

Har du spørgsmål? Chat med Expatax Malta-bot når som helst for at få klar og fortrolig vejledning.