In this final instalment of our three-part series on the property market in Malta, we tackle the number that separates serious investors from casual buyers: rental yield, that is, how much your property is netting you in rent, versus how much you paid (and are paying for) it. It’s where theory meets cash flow — the real test of whether your property is working for you, not the other way around.

We’ve already looked at rents und capital appreciation. Now we bring them together, analysing yields across different property types and regions using over 20,000 live listings compiled by our data scientist, Eliseo Kolicaj.

This isn’t brochure copy or sales-agent spin. It’s real data from the market showing where returns are solid, where they’re slipping, and where investors should tread carefully.

And because context matters, we didn’t stop with Malta. We also compared its performance to five other European markets — looking at yield, rent growthund capital appreciation side by side. If you want to know whether Malta still holds its own in a shifting European landscape, you’re in the right place.

Apartments Yields Are Winning, And It’s Not Even Close!

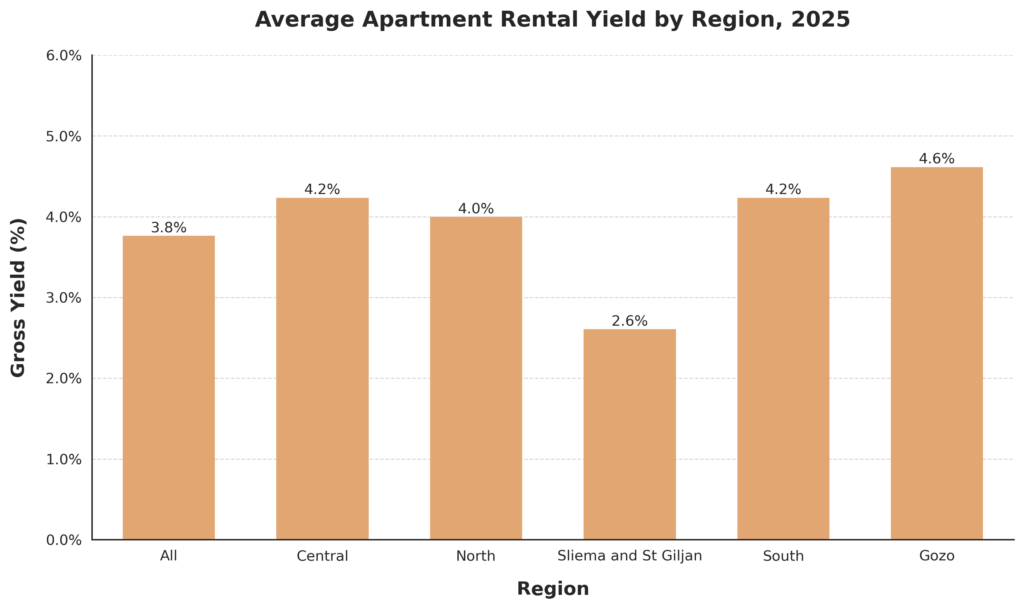

Let’s start with the headline: apartments outperform houses across every region in Malta and Gozo. The national average gross yield for apartments is 3.8%, compared to just 2.5% for houses.

A few reasons we can point at:

- Apartments rent faster (lower vacancy risk)

- They’re cheaper to run (fewer maintenance surprises)

- They’re more accessible (to buyers and tenants alike)

Apartments might not make your heart race, but they do the job: the reliable cash-flow workhorses of Malta’s property market.

Where the Apartment Yields Shine?

Top spot goes to Gozo, with an average yield of 4.6%. Central and South Malta follow at 4.2%, offering strong, stable performance with solid year-round demand.

So what’s driving Gozo’s edge? A mix of lower entry prices, remote-worker demand, and a short-let market with room to grow. Its wider yield distribution shows many landlords exceeding 6%, especially those targeting niche renters or running lean operations.

Mainland investors looking for balance should stick with Central and South Malta: well-connected, still affordable (for now), and not over-saturated.

By contrast, Sliema and St Julian’s — long-time favourites are now underwhelming. Despite high rents, yields are just 2.6%, eroded by lofty property prices and mounting supply. Premium address, average return.

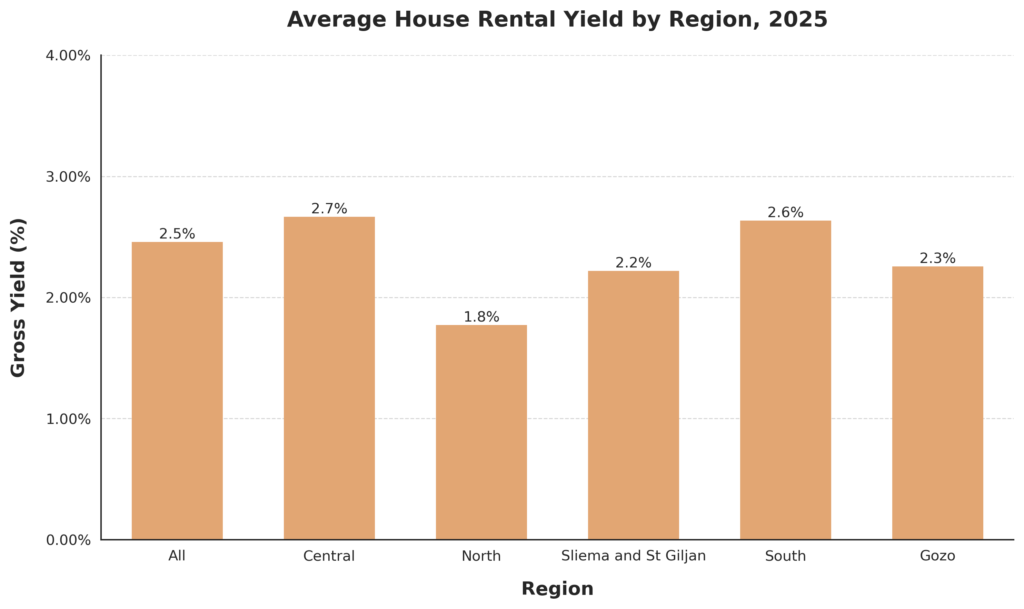

The House That (Barely) Pays

No two ways about it, houses are struggling. The national average yield is 2.5%, and in North Malta it drops to just 1.8% — the worst return in the dataset.

Why? Because while house prices have surged — in some areas by up to 70% since 2020 — rents haven’t kept up. Add in higher maintenance costs (pools, gardens, roofs) and limited appeal for short lets, and it’s no surprise they underperform.

Even in relatively stronger areas like Central (2.7%) or the South (2.6%), house yields still fall short of apartments. They might suit long-term capital growth or lifestyle buyers, but for income-focused investors, they’re simply not pulling their weight.

So yes, you can brag about capital appreciation over dinner — but it’s yield that actually pays for the meal.

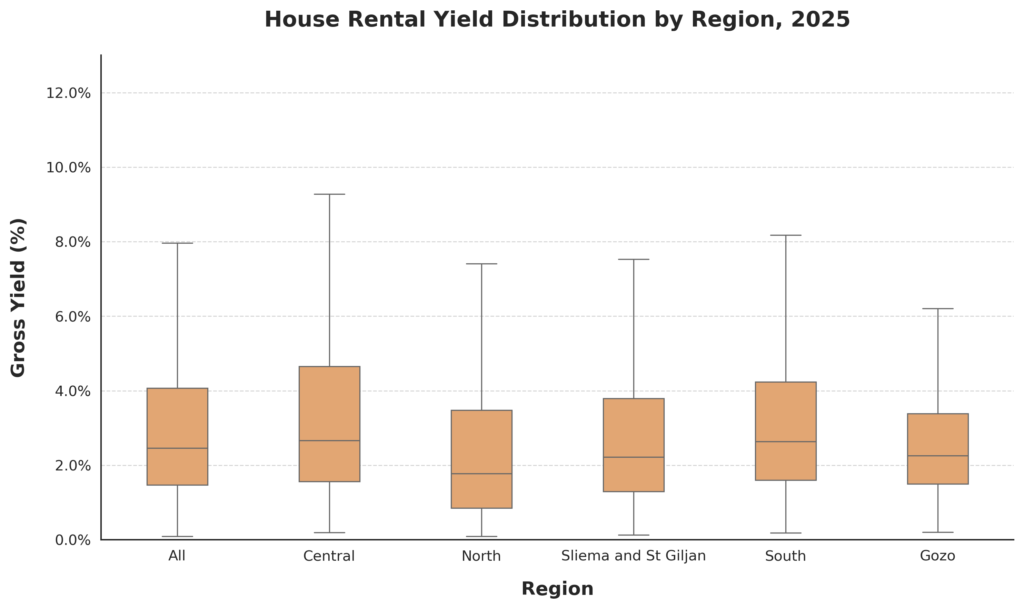

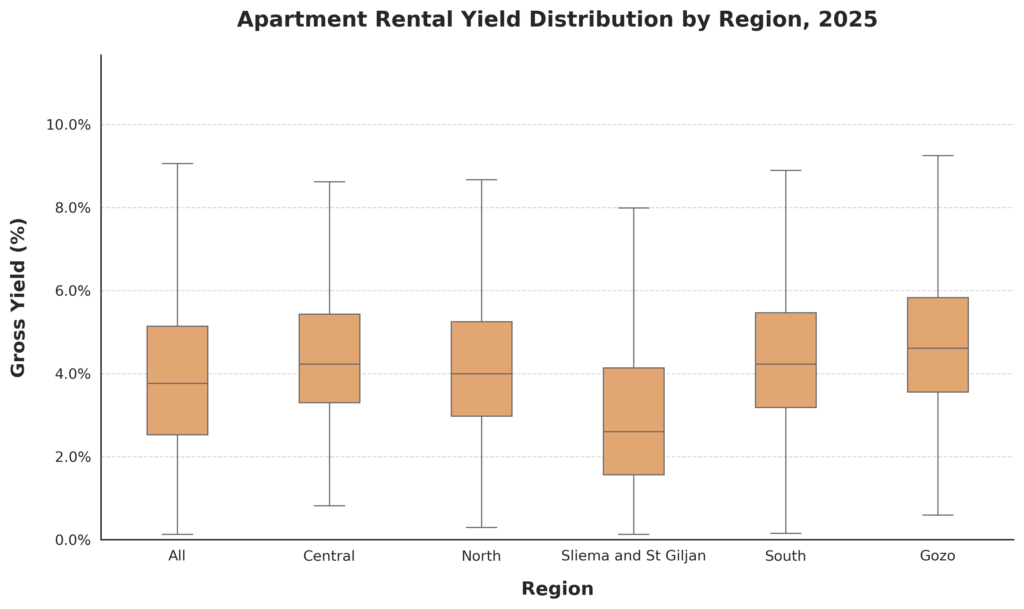

Wide Yield Distribution for Houses

So far, we’ve looked at averages. Now, let’s look at distributions, or, how wide a range property yields cover in various parts of Malta.

Our charts show that yields vary wildly, especially for houses. In some cases, they exceed 8% — but those are often anomalies: old properties bought cheap, or heavy renovation plays. For most investors, that upside’s hard to reach.

Apartments show tighter, more reliable distributions, particularly in Central and Southern Malta. Fewer extremes, more consistency — and consistency is what keeps landlords solvent.

Where to Find Solid Property Yields?

🏆 Go for an apartment in Gozo or the South

🟡 Avoid houses in the North

🤔 Be cautious in Sliema/St Julian’s unless you’re banking on capital gains

🔍 Stick to mid-range units with long-term rental appeal

Appreciation is Nice But Yield Pays the Bills

This research set out to answer one question: what kind of rental returns are investors actually getting in Malta in 2025?

The answer: house prices have surged, especially in the past five years — but yields haven’t kept pace. Rent growth has been modest, and houses are now delivering the weakest returns in the market.

Apartments remain the clear winners on the property market, with consistent yields, lower costs, and strong demand, especially in Gozo, Central, and Southern Malta.

The key takeaway? Rising prices don’t equal strong returns. Yield is still the clearest lens for judging real performance — and many properties aren’t making the cut.

Comparing Property Yields in Malta versus Europe

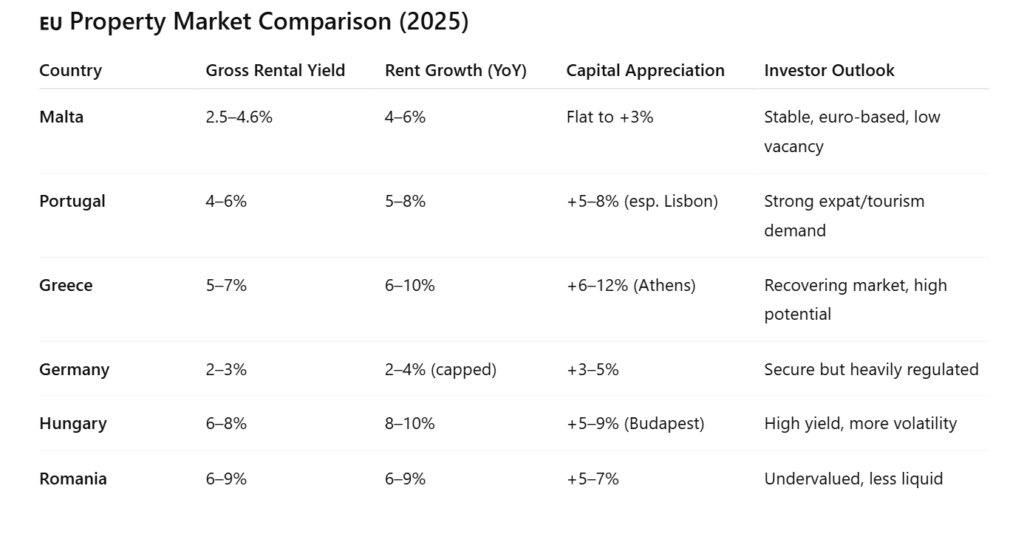

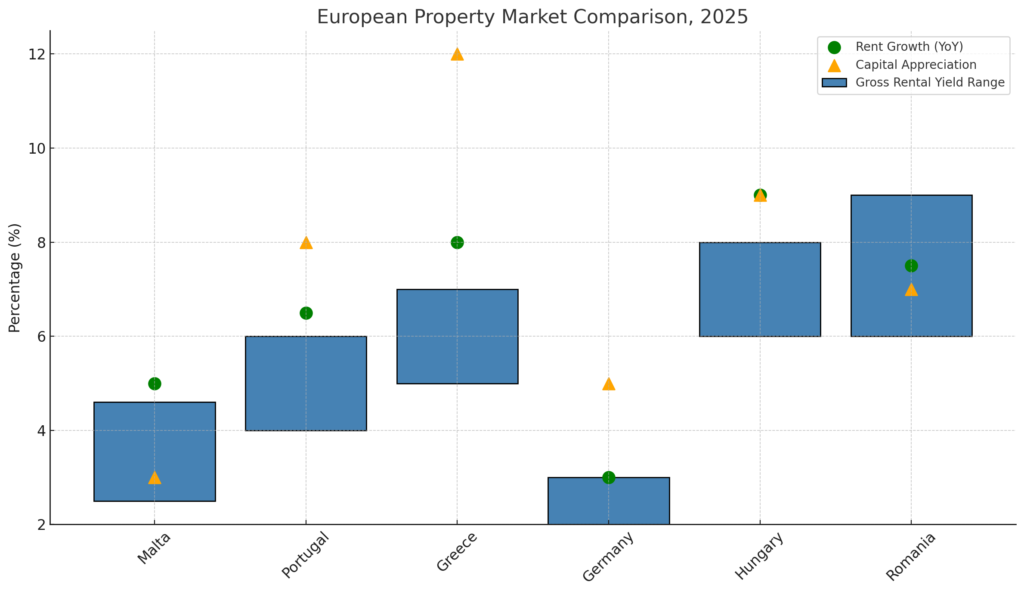

We also wanted to see how Malta stacks up against other European markets in terms of yield, rent growth, and capital appreciation.

So we built a comparative table using public data from national banks, national statistic offices, and reliable property platforms. The result? A fair benchmark of how Malta fits into the broader landscape, and what kind of investor it best serves.

Malta vs Europe: Yields, Rents & Returns

- Malta’s 2.5–4.6% yields comfortably beat Germany’s 2–3%, but the real win is in the paperwork you don’t have to do. German landlords face a maze of tenant-friendly rules — rent caps, permits for short-letsund eviction timelines that can stretch into next year’s tax return. And if you’ve ever had a tenant who stopped paying rent but refused to move out, you’ll know: yield means nothing if you can’t get your keys back. Malta’s legal system is far more forgiving — quick to enforce contracts, light on red tape.

- More stable than Greece, Hungary, or Romania: Yes, you’ll find higher yields in those markets — but they come with strings attached: currency volatility, uneven legal enforcement, and occasional political surprises. In Greece, for example, rental income is taxed progressively starting at 15% — the same as Malta — but with a mandatory 20% prepayment for the following tax year, which means you’re paying tax on income you haven’t even earned yet.

- Malta keeps things simpler: a flat 15% tax on all rental income, whether from short- or long-term leases, with no prepayments or legal acrobatics. It’s one of the most straightforward, landlord-friendly regimes in the EU — and that predictability is worth something.

- Less aggressive than Portugal on growth: Portugal’s property market wins on capital gains and rental momentum, but is harder to navigate since the wind-down of the golden visa scheme. Foreign buyers now face stricter rules, fewer tax incentives, and increased scrutiny. AL licences (short-let permits) are capped or suspended in many municipalities, and local councils are pushing back on tourist rentals to protect housing for residents.

In short, Malta is a stable, euro-denominated income play. Less flashy, more predictable. There’s no regional patchwork of licensing rules, no bans on foreign buyers, and no tightening around short-let permissions, especially outside tourist zones. The property market may grow more slowly, but what you see is what you get — and for many investors, that counts.

Previously on Expatax Malta

If you’ve just jumped in here, you’re missing some context. This yield breakdown is part three of our property series. In case you missed the earlier pieces, we’ve already covered:

Rental Prices in Malta: Houses vs Apartments — what’s driving the gap, and where investors should focus their attention.

Malta & Gozo Property Prices: 2020 vs 2025 — how values have shifted, the where and the why.

Together with this piece on yields, they give you the full picture: what’s grown, what still pays, and what to watch out for in 2025. At Expatax Malta, our goal is to help investors stay ahead of the market, spot the signals early, and avoid the usual traps — preferably before you’ve signed on the dotted line.