Scams in Malta have taken on increasingly sophisticated forms in recent years. A recent investigation by Amphora Media, in collaboration with Swedish Television, OCCRP, and the Times of Malta, has shed light on just how deeply investment fraud has embedded itself in Maltese financial life.

Reporters spoke to 182 scam victims, many caught up in two sprawling criminal networks—one Israeli-European, the other Georgian, that together siphoned off €230 million over four years. Victims span dozens of countries, including Malta, where some of the enabling payment providers were Maltese-registered companies.

In Malta over the past two years, more than €32 million has vanished into scammer pockets and that’s just the reported cases. The real figure? Almost certainly higher. Investment cons, crypto traps, fake banking links, it’s a gold rush for fraudsters.

So, we decided to take a closer look at the kinds of scams in Malta and beyond, and to explore what options are available if you end up getting scammed.

What Kinds of Scams Are Out There?

Scams come in many shapes, but the aim is always the same: get your money or your data. Here are some of the most common traps, both in Malta and beyond.

1. 📩 Fake Messages (Phishing & Smishing)

You get a text or email from your “bank”, or even the “tax office”, or a supplier urging you to click a link or make a payment. In reality, it leads to a fake login page or a scammer-controlled account. You might think you’re paying rent or an invoice, but the money vanishes. These scams often begin with intercepted emails or cloned addresses and end in drained funds — a common type of scam in Malta, frequently reported by individuals and businesses alike.

To protect yourself, always verify payment details before sending money especially if you receive an email claiming a change in bank account. Call the person or company directly using a trusted number, not the one in the email. Also, secure your email accounts with strong passwords and two-factor authentication. Many scams begin by hackers gaining access to email, so keeping that entry point locked is essential.

2. 💰 Upfront Payment Traps (Advance Fee Scams)

You’ve won the lottery! Or inherited millions from a distant uncle! All you have to do is pay a small processing fee… and then another… and another. The promised payout? It never comes. The old saying still holds, if it sounds too good to be true…..

3. 🖥️ Tech Support Cons

A caller claims to be from Microsoft or Apple. They say your device is infected and ask for you to install remote access like Anydesk, claiming it’s needed to fix an issue or guide you through a transaction. Once connected, they can rifle through your computer, harvest personal info, or even make transactions while you watch, (thinking they’re helping). Never grant remote access to unsolicited callers.

4. 🧾 Government Impersonation

“Hello, this is the tax office.” Except it isn’t. Scammers impersonate official bodies and pressure you with threats: fines, deportation, frozen accounts, demanding immediate payment. Their goal is to trigger panic and force a snap decision. Don’t engage. Hang up, or tell them to call back later, then check the number independently before doing anything else. If it does turn out to be fraud, report it immediately to your bank and the police. The sooner you act, the better the chance of limiting the damage. Sadly, around 30% of scam cases of scams in Malta go unreported, often because victims feel too ashamed.

The Scams Keep Evolving

Some scams are more elaborate and often involve significant sums. Here’s what is concerningly on the rise:

5. 🐖 Pig Butchering

These long-game scams start with flirtation or friendship, often through social media or dating apps. Once trust is built, they introduce “investment tips”. Victims end up losing tens of thousands. A few years ago a Silicon Valley tech worker lost over $1 million after meeting a man on a dating app who claimed to be a successful investor. He lured her into using a fake trading platform with convincing visuals and fake profits, encouraging her to make multiple deposits. Eventually, the platform locked her out and the money vanished. The sad thing is, many victims of these scams feel too ashamed to report them—making it even harder to trace or prevent future cases.

6. 🪙 Crypto Exchange Vanishings

This ties into our previous example one day you log in to your crypto platform – and your wallet is empty. Either the exchange was never legitimate, or it’s vanished with your funds. To avoid losing money to fake crypto platforms, use only well-known, regulated exchanges and never invest via links shared by strangers. Be wary of promises of guaranteed returns or time-limited offers, these are red flags. Verify licences, check independent reviews, and consider self-custody for larger sums. Most importantly, never mix online relationships with financial advice if someone new is pushing you to invest, it’s likely a scam.

7. 📉 Disappearing Maturity Values

Some insurance or pension products promise long-term returns. But when the time comes, hidden fees and shifting terms leave your payout shockingly low – or nothing at all. The scam centres often involve perpetrators posing as legitimate brokers, encouraging victims to deposit funds on trading platforms like Rivobanc or Stoxinvest. These platforms typically exist only as websites, falsely claiming to be based in financial hubs like London or Zurich, with no real corporate backing.

Scammers then persuade victims to install remote access software supposedly to help with transactions. Remember that AnyDesk you were convinced to install? Now it’s being used to show you fake gains. The trading dashboard is manipulated to display fabricated profits and “temporarily block” withdrawals. It’s a psychological trap: by making you feel like your investment is growing, they push you to invest even more – until the platform vanishes and your money is gone with it.

The investigation by Amphora Media found that victims of such scams were often targeted a second time. So-called “recovery agents” posing as financial authorities contacted them with promises to retrieve their lost funds. But instead of offering help, they demanded an upfront fee, only to disappear again, compounding the original loss.

📊 Real-World Scam Data for Malta

- 👉 €3.76 million lost in H1 2023 The European Central Bank and EBA report stated that Malta reported around €3.76 million in payment‑fraud losses during the first half of 2023: leading the EU in fraud value terms for that period

- 🔍 Over €21 million lost to online scams in 2022–23 According to Malta’s Anti-Fraud Office (FIAU) and Police fraud unit, more than 1,000 victims were reported, with losses totalling €21 million over those two years .

- 🛡️ 14.4% of all crimes in 2023 were fraud-related data from the University of Malta’s Crime Observatory shows that in 2023, up sharply from earlier years

- 🧠 21% of police reports missed recognising fraud initially. (highlight why the role so the OAFS is so important, but more on that later.) But why not report it? Many felt embarrassed.

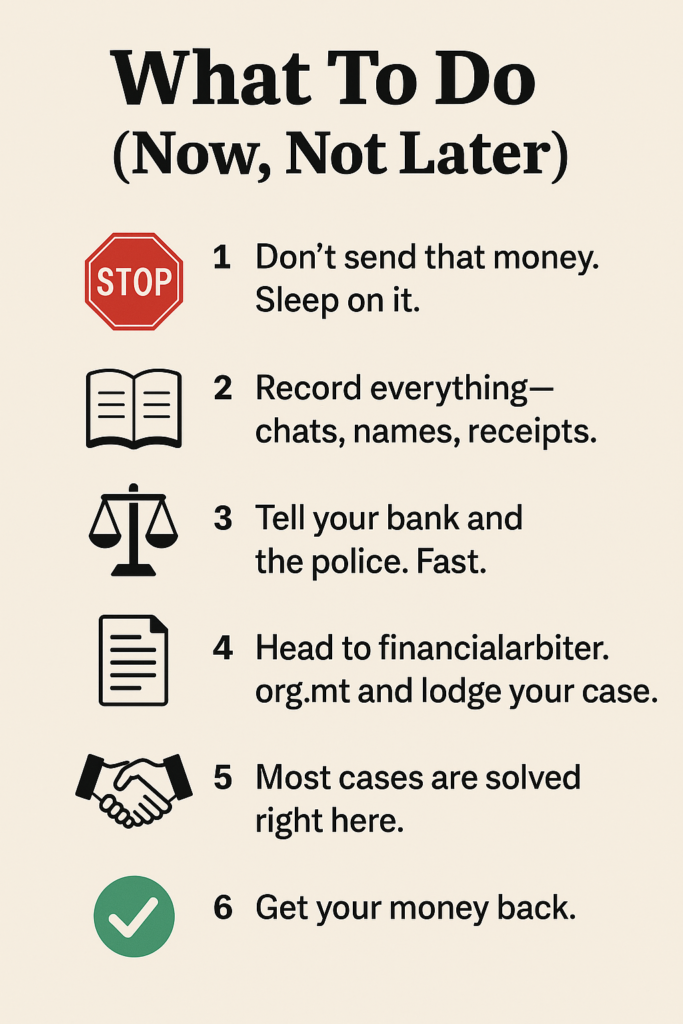

Got Scammed? There’s Help

If you’ve been the victim of a financial scam in Malta, the Office of the Arbiter for Financial Services (OAFS) should be your first port of call. Based in Msida, but complaints can be filled online, the OAFS handles disputes between consumers and licensed financial providers. Complaints cost just €25 to file (refunded if you settle early), and most cases are resolved within three months. Over 50% are settled through mediation, avoiding the need for lengthy proceedings. Crucially, the Arbiter’s rulings are binding on firms—no ifs, buts, or maybes. The OAFS has also reported a steady rise in fraud-related cases in recent years, particularly involving investment scams, payment fraud, and unauthorised transactions—proof that no one is too savvy to fall victim.

In 2024, the OAFS received a record 251 complaints—a nearly 70% jump on the previous year—with the largest share involving bank accounts, insurance, and crypto‑asset issues. Thanks to strengthened mediation services, over 59 cases were settled out of tribunal, up from just 22 in the previous year—and the average time from acceptance to resolution fell to 89 days, about four weeks faster than before. With dispute resolution becoming more efficient and compensation awards rising, in one case as high as €118,000, it’s clear why more people are turning to the Arbiter.

Crypto & Fraud: BIG Losses, Real Recoveries in Cases of Scam

Scams in Malta have become increasingly sophisticated, often blurring the line between legitimate business and digital fraud. From crypto theft to fake e-commerce sites, recent cases show just how easily both individuals and businesses can be caught off guard.

The Crypto.com Case: What Happens When Your Account Is Drained?

In one 2022 case filed in Malta, a user of the Crypto.com app (operated locally by Foris DAX MT Limited) claimed he had been hacked. Roughly $13,880 in crypto vanished overnight—withdrawn, swapped, and sent to another exchange. He said he’d received no login alerts, no 2FA prompts, nothing.

The provider insisted all logins came from a recognised device and argued that the customer’s own email or password had likely been compromised. The Arbiter agreed. The system had worked as intended, and there was no evidence of negligence. The complaint was dismissed.

Lesson: Even if the money disappears, without hard evidence of provider fault, there’s no guarantee of redress. Use strong passwords. Always enable two-factor authentication.

The €12,000 Smartwatch Scam

One particularly clever scam reported in Malta involved a fake tech company offering high-end smartwatches at a “massive limited-time discount.” The site looked professional, the ads were slick, and hundreds of people, including small business owners, placed orders, lured by the steep discounts and countdown timers.

Victims received order confirmations and even shipping notifications. But nothing ever arrived. The entire operation was a front for credit card harvesting. The website vanished within weeks, leaving dozens of buyers not just out of pocket, but with compromised bank details. Some saw fraudulent charges totaling over €12,000.

By the time banks were alerted, the scammers had already cashed out via overseas crypto platforms. While some users recovered part of their losses through their banks and the OAFS, the scam underscored just how convincing digital fraud can be.

The French Case: Big Loss, Bigger Lesson

This case stems from a group complaint brought against Momentum Pensions Malta Limited (MPM) – the Malta-licensed administrator and trustee of a private retirement scheme, previously established under Maltese law and regulated by the MFSA. A number of French investors, holding retirement policies via MPM, noticed their promised returns were far less than expected. The Arbiter reviewed the case, ruled in their favour, and ordered a substantial payout. It was even discussed in UK Parliament. Moral? If a licensed provider fails you, even across borders – you’ve got recourse.

The €19K Mistake That Got Fixed (Mostly)

A Maltese woman transferred €19,150 after falling victim to a well-dressed APP scam. The bank missed warning signs. The Arbiter found that while the woman had been deceived, the bank had also failed to act on red flags, including unusual payment patterns and sudden overseas transfers. In the end, the Arbiter ordered the bank to refund 60% of the loss, citing shared responsibility.

- In 2024, 31 crypto-related cases were filed.

- Most payouts: €1,000–€5,000.

- Top payout? €118,000.

Not Maltese? Still Covered.

If the provider is licensed in or from Malta, you’re eligible to file a complaint. Over half of all complaints actually come from non-residents, so you don’t need to live in Malta to take action. You can submit your case in either English or Maltese, and the process is user-friendly and available online.

Who Can Use the OAFS System?

The Office of the Arbiter for Financial Services (OAFS) is open to:

- Consumers in Malta or abroad, as long as the provider is licensed in or from Malta

- Micro-enterprises, which are small businesses meeting EU criteria

And there’s more: as of 1 October 2025, the law will expand to allow all commercial entities, including larger businesses, to file complaints too. That means SMEs who feel mistreated by a bank, insurer, or crypto provider will soon have access to the same low-cost, high-impact redress system.

It’s also worth noting that in 21% of scam, initially law enforcement reportedly failed to recognise the issue as fraud. So having an alternative path through the OAFS is not just convenient, it may be essential.

One more thing: the majority of scammers are based overseas, making prosecution difficult. That’s why prevention, early reporting, and swift civil redress through the Arbiter are your best lines of defense.

Final Word

We all like to think we’d spot a scam. But the numbers say otherwise. Scams in Malta have affected people across all walks of life — whether you’re a student, retiree, crypto newbie, or property tycoon, fraudsters will try their luck.

The good news? Malta’s complaint system gives you a real shot at redress. But don’t rely on that alone.

Triple-check requests for money. If something feels off, even just a twinge, Pause. Ask questions, lots of them and then Investigate. Don’t be rushed, flattered, or bullied into decisions. Because once the money’s gone, getting it back is hard work, even with help, getting it back is an uphill battle.

A scammer’s worst enemy isn’t the police—it’s a sceptic who takes a minute to double-check. And in a world full of pressure and urgency, that little minute could save you thousands.