If you own a flat in Malta, you’ve probably wrestled with the classic landlord dilemma: play it long and steady, or short and spicy? And yes, we’re talking rentals here — though the analogy to relationships isn’t far off. A long-term let (LTR) offers steady rent, fewer headaches, and (usually) fewer stag parties trashing the place. A short-term let (STR), powered by Airbnb and Booking.com, dangles the lure of fatter nightly rates — but only if you can keep those bookings rolling in.

Using AirDNA data for Malta (2025), we looked at advertised STRs and compared them against listed LTRs, adjusting for realistic occupancy:

- LTRs at 90% occupancy (allowing for voids, turnover, and the occasional awkward repair).

- STRs at 60% occupancy (nobody runs at 100%, unless you’re handing out free cocktails at the door).

We analysed hundreds of properties across Malta and Gozo, slicing by region and bedrooms. The goal: to see which strategy brings in the most bang for your euro.

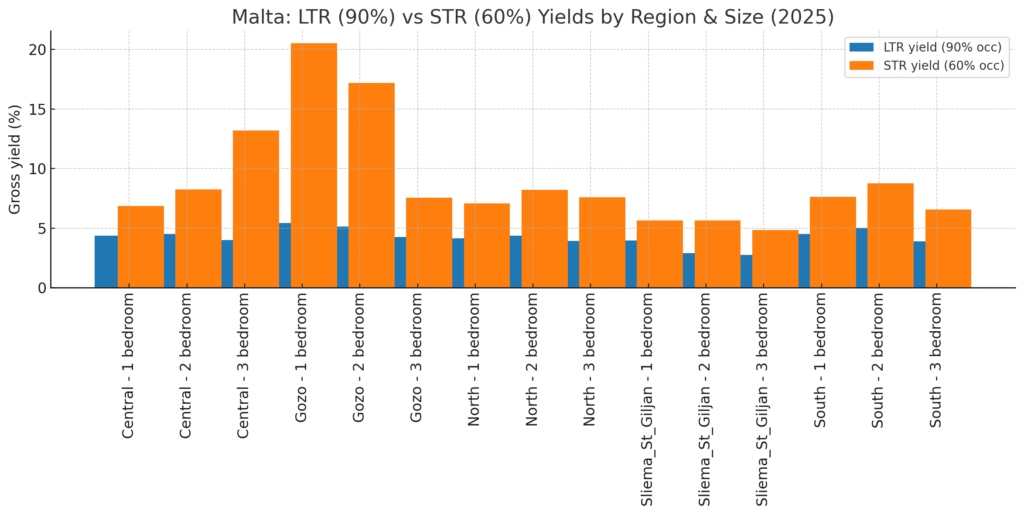

STR Yield up to 20% in Gozo

Here’s where it gets crunchy. A few highlights from the tables (all yields annualised, % of property value):

| Region | Property | LTR Yield (90%) | STR Yield (Median, 60%) | Winner |

|---|---|---|---|---|

| Central | 1-bed | 4.4% | 6.8% | STR (modest edge) |

| Central | 3-bed | 4.0% | 13.2% | STR (big winner) |

| Gozo | 1-bed | 5.4% | 20.3% | STR (if you can stand ferry delays) |

| Gozo | 3-bed | 4.3% | 7.6% | STR (but slim margin) |

| North | 2-bed | 4.4% | 8.2% | STR |

| Sliema/St Julian’s | 2-bed | 2.9% | 5.6% | STR, but underwhelming |

| South | 2-bed | 5.0% | 8.8% | STR, quietly strong |

On Average STRs Deliver Double the Returns V LTR Yield

On average across Malta, LTRs deliver around 4% yield, while STRs at 60% occupancy return 8–9% — roughly double. Lets take a closer look at the disparity.

Gozo in a league of its own

One-bed units in Gozo churn out yields above 20% at 60% occupancy, with two-beds not far behind at 17%. That’s several times stronger than the 4–5% offered by long-lets. The catch? The island only has a handful of listings — scarcity magnifies the returns.

Central 3-beds: unicorn territory

In Central Malta, 3-beds post yields of around 13%, but our sample size was too small to be statistically reliable. It’s best seen as an outlier rather than a trend, though it does hint at the kind of upside landlords can capture at the top end of the market.

Sliema/St Julian’s paradox

Despite being Malta’s most glamorous and tourist-heavy market, Sliema and St Julian’s underperform. One- and two-beds barely scrape 5–6% yields, dragged down by oversupply, so landlords compete for guests.

South: quietly steady

Often overlooked, the South holds its ground with yields in the 7–9% range across most property sizes. Nothing flashy, but solid and reliable compared to its better-known neighbours.

North: middle of the road

The North delivers middling yields — decent on 2-beds (~8%) but otherwise unremarkable. Its strength is balance: a healthier mix of unit sizes that cater to families and longer stays.

Long-lets: dull but dependable

LTRs sit almost everywhere between 4% and 5%, regardless of size or region. They’re the safe option, the equivalent of a savings account: predictable, and steady.

The real oddity

Gozo feels like it’s playing a different game entirely — cheap property, strong demand, and limited competition combine to leave the rest of Malta trailing behind.

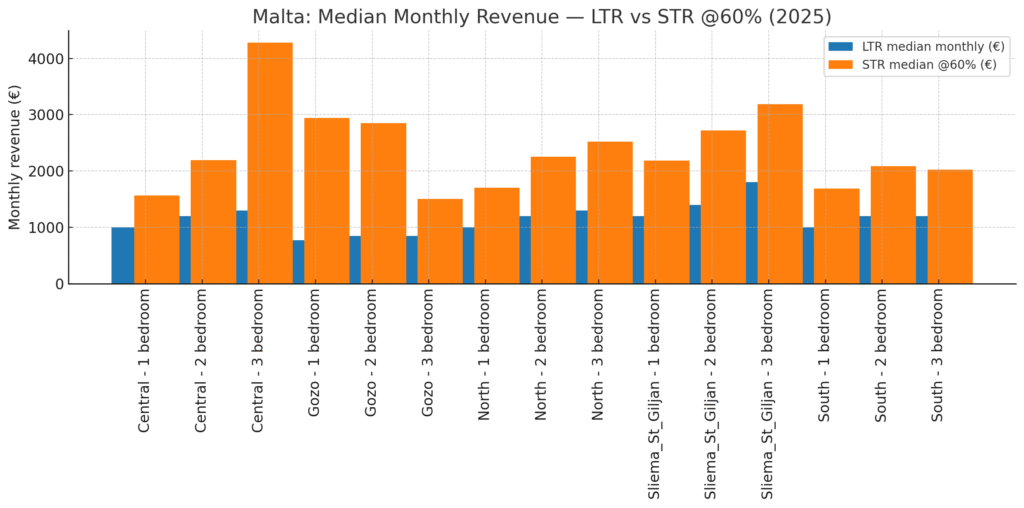

Central Malta: 3-bed Short Lets brings in around €4,200 a month

In Central Malta, the revenue gap is striking. A 3-bed STR brings in around €4,200 a month at 60% occupancy, compared with just €1,300 for an LTR. Even the smaller units hold their own: a 2-bed STR nets about €2,200, well ahead of the €1,200 from a long-let.

Gozo is even more dramatic. A 1-bed STR earns roughly €2,900 versus €775 LTR, and a 2-bed pulls in €2,850 compared to €850. With property prices lower on the island, the cash-flow uplift looks outrageous.

The North sits somewhere in the middle. A 2-bed STR averages €2,250, against €1,200 for an LTR. It’s a healthy premium, though less explosive than Gozo or Central.

In Sliema/St Julian’s, STRs perform well on paper — a 2-bed clears €2,700 vs €1,400 LTR, and a 3-bed pushes €3,200. But the region’s high property costs take the shine off those numbers.

The South is steady rather than spectacular. A 2-bed STR earns about €2,100 compared to €1,200 LTR, while 3-beds sit at €2,000 vs €1,200. The margins here are narrower than elsewhere.

Overall, STRs consistently outpace LTRs in monthly income, but the size of the advantage varies sharply by location — with Gozo the clear runaway winner.

8,000+ Active STRs in Malta.

Back in early 2020, AirDNA recorded roughly 11,330 active Airbnb rental listings across Malta, dippBack in early 2020, AirDNA counted around 11,300 active listings across Malta (dropping to just over 10,000 as the pandemic hit). Now, the most recent sources (InsideAirbnb, Airbtics, AirROI) put the total closer to 8,000+ active entire-home STRs.

So despite tourism having fully recovered, the number of listings is actually lower today than pre-COVID. A few likely reasons:

Market saturation in hotspots like Sliema/St Julian’s, pushing weaker operators out..

Regulatory tightening (MTA licensing rules and Planning Authority oversight).

Host attrition during the pandemic — many landlords switched back to long-lets and never returned.

Rising property prices making STR less compelling for new entrants.

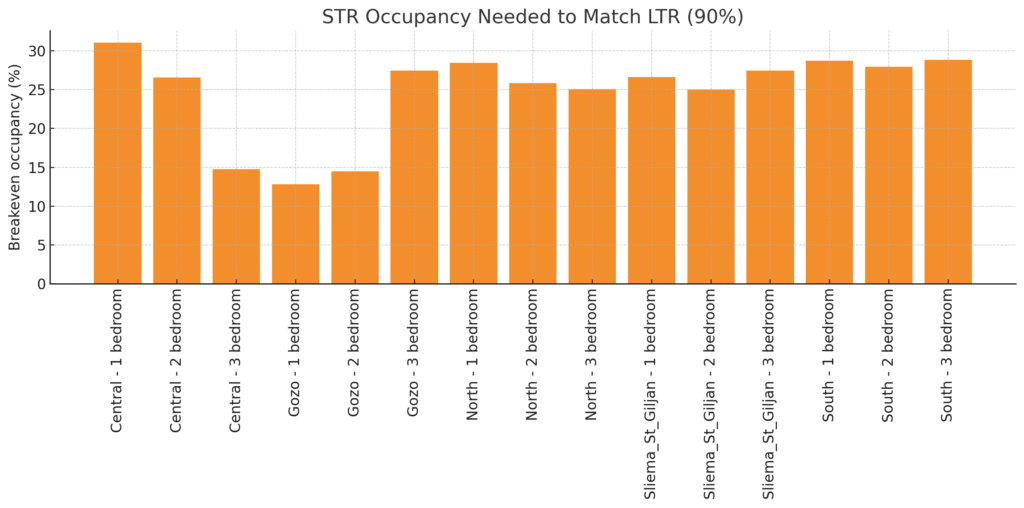

Just 4 Months of Short-lets can Match a Full Year of Long-let Income

This chart shows how many nights you’d need to rent a short-let to make the same as a long-let that’s occupied almost all year.

Sliema/St Julian’s: Similar at 90–100 nights, but with so many listings on the market, competition makes filling those nights tougher.

Central Malta: A 1-bed needs about 115 nights (31%) to match an LTR, while a 3-bed only needs 55 nights (15%).

Gozo: The standout. A 1-bed needs just 47 nights, and a 2-bed about 52–55 nights. In other words, one good summer season could cover the whole year.

North & South: Most units need 90–105 nights. That’s roughly 3–4 busy months of bookings to keep pace with a long-let.

Overall, the message is clear: most STRs don’t need to be booked solid to beat a long-let rentals. With breakeven points as low as 13% in Gozo and rarely above 30% anywhere else, the odds are firmly stacked in favour of short-lets — provided you can manage the extra hassle.

Short Term Rentals Win on Yields

For landlords weighing up the choice, the maths is clear: short-term rentals can deliver far higher returns than long-term lets, and at surprisingly low occupancy levels. In many cases, you only need to fill the place a quarter of the time to beat the steady but modest long-let income.

That said, STRs aren’t a free ride. They bring cleaning bills, higher utility costs, and a steady stream of guest queries (“how do I work the remote?”). On top of that, guests usually expect more than a long-term tenant would — fresh linen, fast Wi-Fi, and everything working perfectly from day one.

So while LTRs are the steady plodders – low drama, dependable income – STRs are the flashier cousins: more effort, more upkeep, but also a lot more money in the right locations.