Simplifying Taxes, Visas,

And Business for Expats in Malta

Expert advice on tax, residency, and setting up a business in Malta to assist you on your relocation journey.

AI-powered tax assistant

Got tax questions? Let our intelligent AI assistant guide you. Tap into our rich knowledge base for quick, reliable answers

Expert consultation

Need guidance that fits your unique situation? Book a session with our accountants for personalized, strategic tax solutions.

Ongoing Tax Management

Stay stress-free with our ongoing tax management. From routine updates to annual filings, we handle everything!.

Recent Posts

Relocation

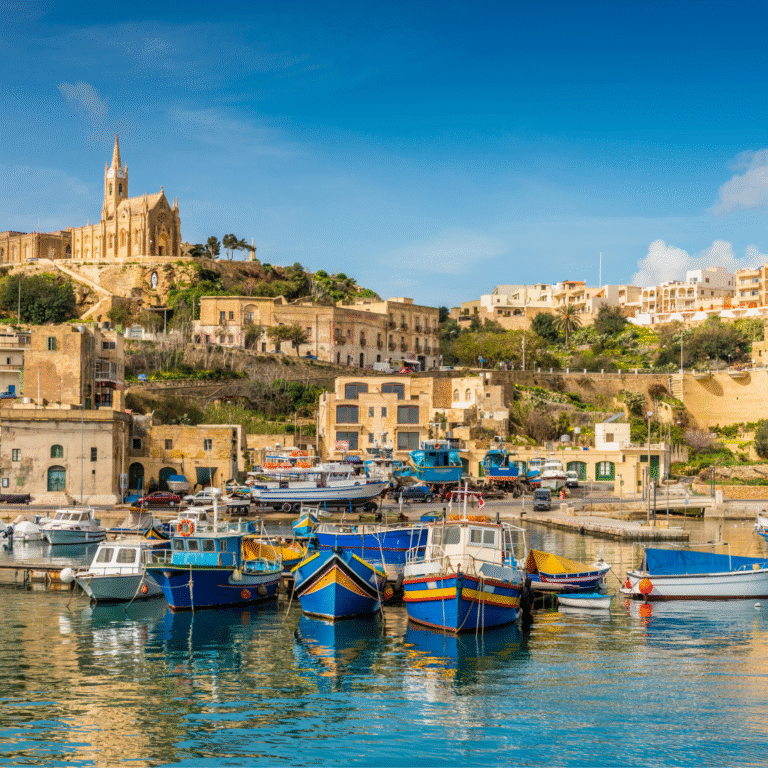

Best Places to Live in Malta for Expats: Gozo

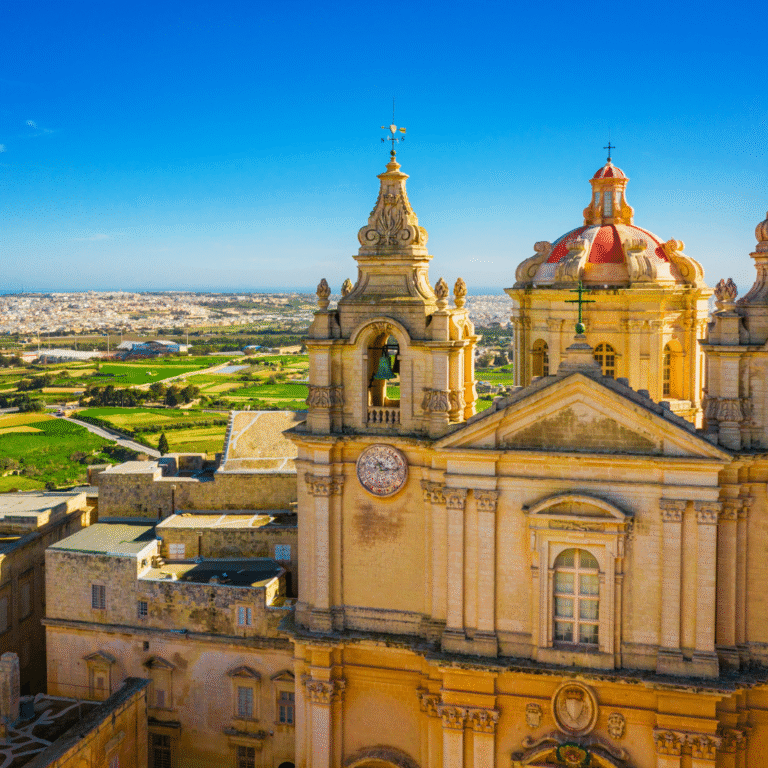

Western District Malta: Space, Character, and Village-Life for Expats

Best places to Live in Malta: Southern Harbour District

Best Places to Live in Malta for Expats: South Eastern District

Best Places to Live in Malta for Expats: Northern District

Best Places to Live in Malta for Expats: Northern Harbour

Interviews

Meet Alen Osman: Founder of Mamma’s Sugar and His Citizenship Journey in Malta

Meet Paulina Zaborowicz “When Passion Meets Community, You Find Where You Belong”

Meet Tatia: How Georgian Taste Shaped Serendipity Café in Gozo

Meet Barbara, the Woman Behind Bizzart Services

When Malta Changes You: Viviana’s Global Mindset Journey

The Other Side of New Labour Law with Patricia Graham

Lifestyle

Pension Exemption 2026: What Retirees in Malta Need to Know

Food Prices in Malta: Official Data Shows a 3.4% Increase

Young Drivers in Malta Can Earn €25,000 by Voluntarily Surrendering Their Driving Licence in 2026

Public vs Private Healthcare in Malta

Looking Back at 2025: A Year of Change, Clarity, and a Growing Expat Community in Malta

New Year’s Eve in Malta and Gozo: Where to go Last Minute

Doing Business

HR and Payroll in Malta: January 2026 Compliance Overview

Understanding FIFO First In First Out Inventory Method in Malta

Redundancy in Malta: Rights, Obligations, and What Happens Next

Hiring and Terminating in Malta: Employment Framework

Government Confirms Mandatory €250 Integration Course for First-Time TCN Applicants in 2026

Malta’s Catering Sector Warns: Without TCNs, We’d Be Serving Fresh Air Instead of Food

Taxes

MicroInvest 2026 in Malta: A Practical Tax Credit Guide for SMEs and the Self-Employed

Malta 2026 Tax Guide for Families: The FS4 Categories That Can Save You Money

A Guide to Remittance Basis in Malta

Returning to Work After Maternity Leave – Tax Rebates

Working Between UK and Malta? Here’s How to Not Get Taxed Twice

Residency and Visas

EU Self-Sufficient Residence in Malta

Residency Procedures for an Expat Child Born in Malta

Malta’s Pre-Departure Course Explained

Living Irregularly in Malta

The British Community in Malta Today

I Belong Stage 1 Is Under Restructuring: What Applicants Need to Know

Tax Questions? Ask TAX AI.

We mix AI-driven advice with expert knowledge for everyone considering moving to Malta.

Subscribe To Our Newsletter

Stay up to date with the most recent news about Maltese taxation, from annual government budgets to developments in personal and business taxation. We write with international expats and digital nomads in mind.

Let`s Get Social

Discover why Malta is becoming the crypto capital of Europe. Get our e-book to explore the benefits, regulations, and opportunities for crypto investors.

Buy Now