Redundancy in Malta is one of the most sensitive employment situations for both employers and employees.Redundancy is regulated by the Employment and Industrial Relations Act (Cap. 452) and supported by a framework that combines employment law, social security, and, in many cases, immigration considerations.

This article explains how redundancy works in Malta, what employers must do, what employees are entitled to receive, and how the situation differs for Maltese nationals, EU citizens, Long-Term Residents, and Third-Country Nationals (TCNs).

What Redundancy Means Under Maltese Law

In Malta, redundancy refers to the termination of employment for reasons not related to employee conduct or performance, but to the employer’s operational requirements. Typical redundancy situations include business restructuring, lack of work, closure of a department, technological changes, or company downsizing.

A redundancy must be genuine and objectively justified. While an employer is allowed to terminate employment on redundancy grounds, the process must still respect statutory notice periods, fair selection criteria, and additional obligations in collective redundancy scenarios.

Notice Periods in Redundancy in Malta

Redundancy does not remove the obligation to give notice. Notice periods are determined by the employee’s continuous length of service:

| Length of Service | Minimum Notice |

|---|---|

| More than 1 month up to 6 months | 1 week |

| More than 6 months up to 2 years | 2 weeks |

| More than 2 years up to 4 years | 4 weeks |

| More than 4 years up to 7 years | 8 weeks |

| Over 7 years | 8 weeks + 1 week per additional year (up to 12 weeks max) |

Payment in lieu of notice must be paid in full if termination is employer-initiated.

If the employee chooses not to work the notice period, only half the wages for the unexpired period are payable.

Selecting Employees for Redundancy

One of the most common legal risks in redundancy cases lies in selection, not the redundancy itself. In practice, Maltese employment law recognises the principle of “last in, first out” (LIFO), unless there are objective reasons to apply different criteria. Employers must be able to justify their selection method and apply it consistently, particularly where multiple employees perform similar roles.

Collective Redundancies

Additional legal requirements apply where redundancies reach certain thresholds within a 30-day period:

- 10 or more employees in establishments with 20–99 employees

- 10% or more in establishments with 100–299 employees

- 30 or more employees in establishments with 300+ employees

In these cases, employers must:

- Notify employee representatives and the Director of Industrial and Employment Relations (DIER) in writing

- Enter into consultation within seven working days

- Provide detailed information on reasons, numbers affected, selection criteria, and timing

- Observe a mandatory waiting period before terminations take effect

Failure to comply may result in administrative penalties per affected employee.

Re-Engagement Obligation

A lesser-known but important rule is the one-year re-engagement obligation.

If a role that was made redundant becomes available again within 12 months, the employer is legally required to offer it back to the employee who was made redundant. Failure to do so may give rise to a claim before the Industrial Tribunal.

Jobsplus Support

Arrangement with box and unemployed sign – Redundancy in Malta

Following redundancy, Jobsplus plays a central role in supporting affected employees by facilitating access to unemployment benefits, job-matching services, and guidance during the transition back into employment.

Registration as a Jobseeker

Employees made redundant may register with Jobsplus, Malta’s public employment service. Registration enables access to:

- Job matching and vacancy referrals

- Career guidance and training opportunities

- Unemployment benefits, where eligible

Unemployment Benefit: Up to Six Months

Maltese nationals and EU citizens who meet social security contribution requirements may qualify for unemployment benefit for up to 156 days (approximately six months).

Key features:

- The benefit is tapered, decreasing gradually over the benefit period

- Payment levels are linked to previous earnings, within statutory caps

- Continued eligibility requires active job seeking and compliance with Jobsplus obligations

The benefit is not automatic and depends on prior contributions and registration.

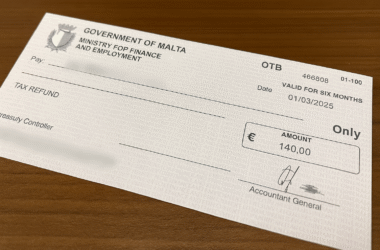

How Much Unemployment Benefit Can You Expect?

In practical terms, unemployment benefit is calculated as a percentage of your previous earnings and gradually decreases over time. At the beginning of the benefit period, you can generally expect to receive around 60% of your average wage, which then reduces to approximately 55%, and later to around 50% as the benefit period progresses. Payments are subject to statutory minimum and maximum limits, meaning higher earners will receive support only up to a capped amount.

To receive and continue receiving the benefit, you must register with Jobsplus, remain available for work, and actively engage in the job-search process. Failure to comply with these requirements may result in the benefit being reduced or stopped.

EU Citizens and Equal Treatment

EU citizens legally employed in Malta are entitled to equal treatment in relation to unemployment benefits and Jobsplus services, provided they have paid sufficient social security contributions in Malta. Registration and documentation are essential to avoid delays or refusals.

Third-Country Nationals (TCNs)

While TCNs may register with Jobsplus as jobseekers, redundancy does not automatically grant a right to remain in Malta, therefore access to unemployment benefit following redundancy in Malta is generally restricted, and failure to secure new employment (Single-Work Permit) within the permitted time-frame may lead to loss of residence status.

Long-Term Residents

Individuals holding Long-Term Resident (LTR) status are in a stronger position.

Long-Term Residents:

- Are not tied to a single employer

- May register with Jobsplus

- May qualify for unemployment benefits, subject to contribution conditions

- Are generally treated closer to EU nationals for social security purposes

What to Keep in Mind

Redundancy in Malta is not just an employment issue. It sits at the intersection of labour law, social security, and immigration, particularly in an international workforce environment. Understanding the rules on notice, selection, benefits, and residence implications is essential for both employers and employees.

At Expatax Malta, we assist individuals and businesses in navigating redundancy situations with clarity and compliance, ensuring that employment rights, social security entitlements, and residence obligations are properly aligned.

Follow us across our social media channels for more daily insights

For an initial consultation on this topic or if you have any other inquiries, fill out the Expatax Malta contact form. A member of our team will get in touch with you promptly.