Malta’s government has started distributing its annual ‘tax-refund’ cheques to residents for basis year 2024 — a recurring measure that rewards employees who paid their taxes through the Pay-As-You-Earn (PAYE) system. Known officially as the Rewarding Hard Work scheme, this initiative has become a yearly tradition, returning part of the tax collected from workers and ensuring that lower- and middle-income earners share in the country’s economic progress.

If you live or work in Malta, you may already have received your cheque in the post, or can expect it soon. Here’s what to know about how the scheme works, who qualifies, and why it matters.

Latest Update

According to Times of Malta, the government began issuing this year’s batch of cheques at the start of November, confirming that hundreds of thousands of residents will receive them over the coming weeks. The Ministry for Finance described the measure as part of Malta’s ongoing commitment to reward consistent taxpayers, noting that both Maltese citizens and foreign residents registered in employment are eligible.

The news report also highlighted that in 2024 alone, more than 269,000 cheques were sent out under the same scheme, with refunds ranging from €60 to €140, depending on income level.

What the Tax-Refund Cheques Are

These cheques are a direct financial rebate introduced by the Maltese government in 2018 to recognise compliant taxpayers. This is not a one-off payment, but a recurring annual refund for employees whose income falls within certain brackets.

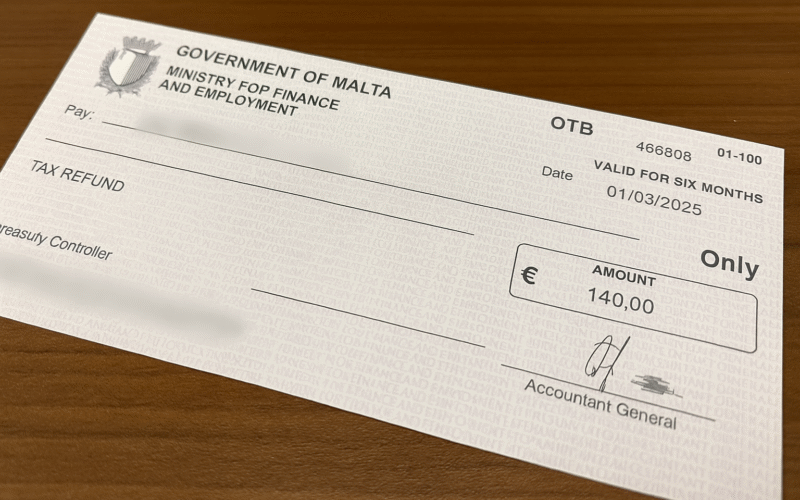

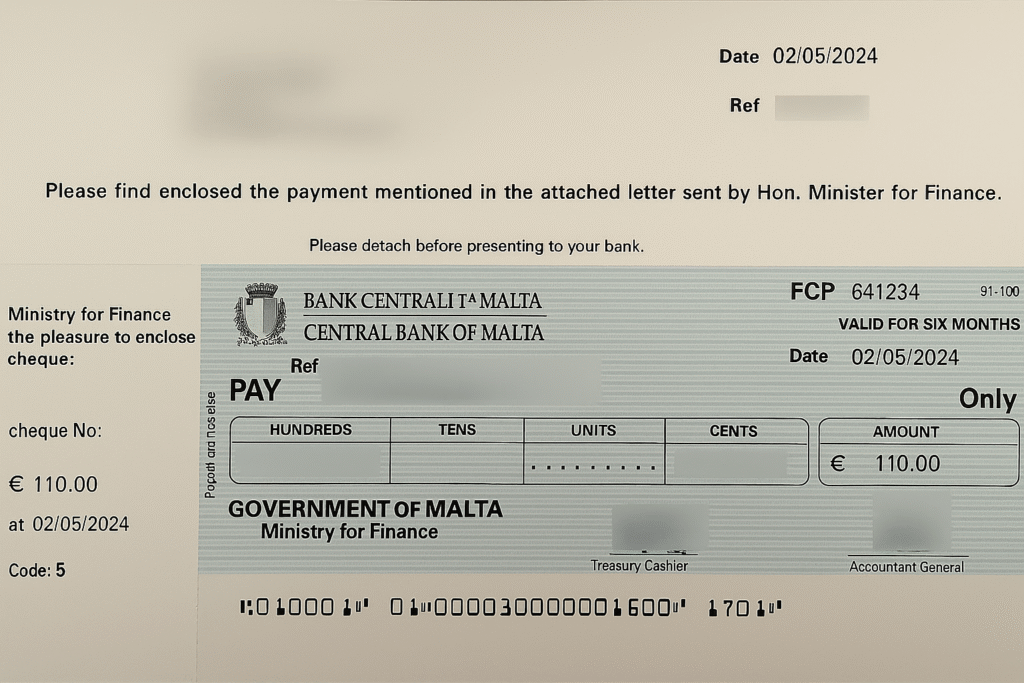

Each qualifying worker receives an amount that varies according to income, with those on lower salaries receiving a higher refund. The average amount is between €60 and €140, with specific rates determined each year by the Ministry for Finance.

According to data published by Times of Malta, more than €25 million is typically distributed nationwide through these tax-refund cheques each year – a measure that continues to enjoy broad support among employees and families.

Who Qualifies

Eligibility is automatic for individuals who:

- Are registered employees paying tax under the PAYE system;

- Have been employed in Malta during the qualifying tax year;

- Are compliant with their tax obligations; and

- Are recorded as tax residents or registered workers in Malta.

The ‘bonus’ scheme covers both Maltese and non-Maltese employees working in Malta. Self-employed individuals, however, are excluded from this programme, as their tax contributions are managed differently through annual returns rather than payroll deductions.

Cheques are sent to the address listed in the government’s records. Those who have changed address recently should ensure their details are up to date with Jobsplus or the Commissioner for Revenue to avoid delivery delays.

To make it easier to understand who benefits from the annual tax-refund, the following table outlines the typical income bands and corresponding cheque amounts issued under the “Rewarding Hard Work” scheme:

| Tax Status | Income Band | Approximate Refund Cheque* | Eligibility Notes |

|---|---|---|---|

| Single | €0 – €15,000 | ~ €125 | Eligible if employed and records clear |

| Single | €15,001 – €30,000 | ~ €95 | |

| Single | €30,001 – €59,999 | ~ €60 | |

| Married | €0 – €20,000 | ~ €140 | Combined spouse income under this cap |

| Married | €20,001 – €40,000 | ~ €110 | |

| Married | €40,001 – €59,999 | ~ €65 | |

| Parent (single parent) | €0 – €15,000 | ~ €135 | Parent tax computation rules apply |

| Parent | €15,001 – €30,000 | ~ €105 | |

| Parent | €30,001 – €59,999 | ~ €60 | |

| — | ≥ €60,000 (all tax statuses) | Not eligible | Income above €60,000 disqualifies you |

Year-End Clearance and Tax Balance

While the government issues the annual tax-refund cheques automatically based on PAYE and employment data, the Commissioner for Revenue (CFR) continues reconciling each taxpayer’s record for the corresponding year. This means that while you may receive your cheque before the official clearance is finalised, your tax compliance status still matters. If your account shows outstanding payments, missing returns, or irregularities, future refunds could be delayed or adjusted. It’s therefore advisable to log in to your MyTax account to confirm that your tax position is correct and up to date. Adding your bank details in the same portal ensures that any future refunds are transferred directly to your account instead of arriving as a physical cheque.

Once your 2024 tax year is officially cleared, you will receive a statement showing your tax position — this may indicate:

- A balance due, if you have underpaid tax during the year;

- A credit, if you have overpaid through PAYE; or

- A zero balance, meaning your tax is fully settled.

How and When Cheques Are Delivered

Distribution usually begins in autumn, with cheques sent by MaltaPost in batches over several weeks. Delivery is managed by the Ministry for Finance, and no application is required, eligibility is calculated automatically from payroll and tax data.

Recipients can deposit or cash their cheques at any local bank. Cheques that remain uncashed after several months may expire, though replacements can be requested through the Finance Ministry’s customer service team or via Servizz.gov.

Note for Third-Country Nationals (TCNs)

For majority of third-country nationals (TCNs), tax-refund cheques will be sent to the employer’s registered business address rather than the employee’s personal address.

If you have recently changed jobs, it’s possible that your cheque has been delivered to your previous employer’s address. In this case, contact your former employer to check whether it has been received, or reach out directly to the Commissioner for Revenue (CFR) to confirm the address on record and request redirection if needed.

Why These Cheques Matter

This initiative is both financial and symbolic. It recognises the contribution of Malta’s workforce, particularly those on moderate incomes, and strengthens confidence in the tax system by demonstrating that good compliance leads to tangible returns.

For employees, the cheque offers a small but meaningful financial boost that often coincides with year-end expenses. For employers, it supports morale and signals that Malta values productive, tax-compliant work – an important message for the country’s growing expat community.

In 2024, government data showed that nearly €4 million worth of cheques from previous years went uncashed, largely due to outdated addresses or workers leaving the country before receiving them, a reminder to always keep your records current.

If You Haven’t Received Yours

If your cheque hasn’t arrived yet:

- Verify your postal address with Jobsplus and the Commissioner for Revenue.

- Confirm your employment status and that you are registered under PAYE.

- Report missing or expired cheques directly through Servizz.gov or the Finance Ministry’s Customer Care Unit.

No application process is needed — payments are issued automatically to eligible employees.

Why It Matters for Residents

For residents and foreign workers alike, these cheques are a clear sign of how Malta encourages tax compliance and rewards those contributing to the economy. They help offset the cost of living, reinforce trust in public systems, and strengthen the link between employment and shared prosperity.

In short: If you’ve been working and paying taxes in Malta, watch your mailbox — your annual government tax-refund refund cheque may already be on its way.