If you own a flat in Malta, you’ve probably asked yourself: Should I go long and steady, or short and spicy? We’re talking rentals, not relationships though the comparison holds. A long-term let (LTR) means consistent rent, fewer tenant headaches, and (usually) fewer stag parties. A short-term let (STR) the Airbnbs et Booking.coms of the world, promises higher nightly returns, but only if you can keep those bookings coming.

Using AirDNA data for Malta (2025), we looked at advertised STRs and compared them against listed LTRs, adjusting for realistic occupancy:

- LTRs at 90% occupancy (allowing for voids, turnover, and the occasional awkward repair).

- STRs at 60% occupancy (nobody runs at 100%, unless you’re handing out free cocktails at the door).

We analysed 261 properties across Malta and Gozo, slicing by region and bedrooms. The goal: to see which strategy brings in the most bang for your euro.

The Numbers (Illustrated)

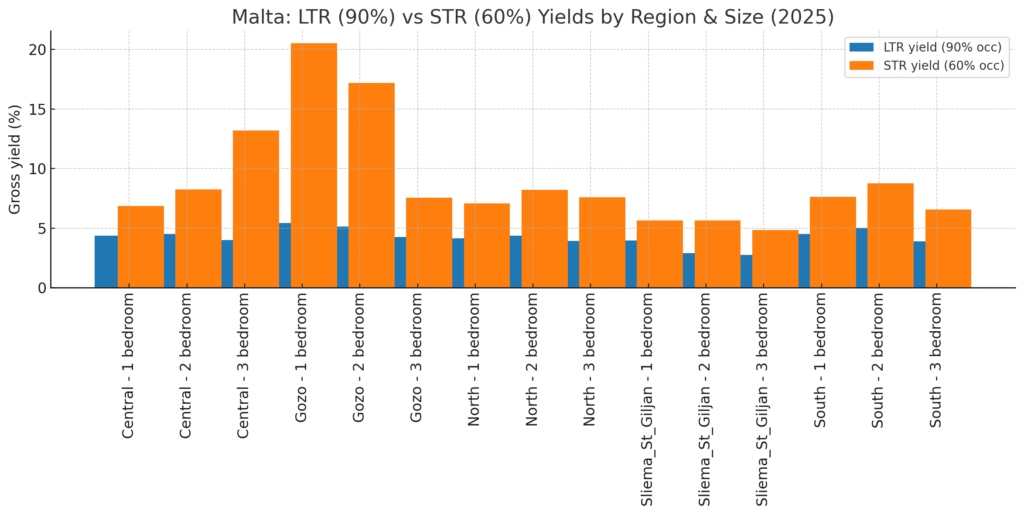

Here’s where it gets crunchy. A few highlights from the tables (all yields annualised, % of property value):

| Region | Propriété | LTR Yield (90%) | STR Yield (Median, 60%) | Winner |

|---|---|---|---|---|

| Centrale | 1-bed | 4.4% | 6.8% | STR (modest edge) |

| Centrale | 3-bed | 4.0% | 13.2% | STR (big winner) |

| Gozo | 1-bed | 5.4% | 20.5% | STR (if you can stand ferry delays) |

| Gozo | 3-bed | 4.3% | 7.6% | STR (but slim margin) |

| Nord | 2-bed | 4.4% | 8.2% | STR |

| Sliema/St Julian’s | 2-bed | 2.9% | 5.6% | STR, but underwhelming |

| South | 2-bed | 5.0% | 8.8% | STR, quietly strong |

Gozo in a league of its own

One-bed units in Gozo churn out yields above 20% at 60% occupancy, with two-beds not far behind at 17%. That’s several times stronger than the 4–5% offered by long-lets. The catch? The island only has a handful of listings — scarcity magnifies the returns.

Central 3-beds: unicorn territory

In Central Malta, 3-beds show off yields of around 13%, but with only two properties in the sample, it’s more outlier than trend. Still, it shows what’s possible at the upper end.

Sliema/St Julian’s paradox

Despite being Malta’s most glamorous and tourist-heavy market, Sliema and St Julian’s underperform. One- and two-beds barely scrape 5–6% yields, dragged down by oversupply — in this dataset, nearly a hundred one-beds compete for guests.

South: quietly steady

Often overlooked, the South holds its ground with yields in the 7–9% range across most property sizes. Nothing flashy, but solid and reliable compared to its better-known neighbours.

North: middle of the road

The North delivers middling yields — decent on 2-beds (~8%) but otherwise unremarkable. Its strength is balance: a healthier mix of unit sizes that cater to families and longer stays.

Long-lets: dull but dependable

LTRs sit almost everywhere between 4% and 5%, regardless of size or region. They’re the safe option, the equivalent of a savings account: predictable, steady, and a little boring.

The real oddity

Gozo feels like it’s playing a different game entirely — cheap property, strong demand, and limited competition combine to leave the rest of Malta trailing behind.

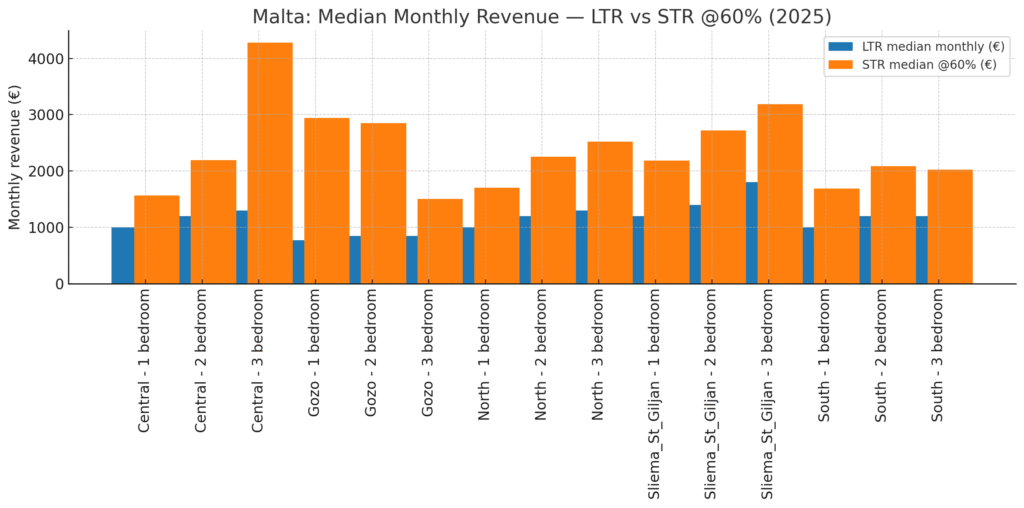

En Centre de Malte, the revenue gap is striking. A 3-bed STR brings in around €4,200 a month at 60% occupancy, compared with just €1,300 for an LTR. Even the smaller units hold their own: a 2-bed STR nets about €2,200, well ahead of the €1,200 from a long-let.

Gozo is even more dramatic. A 1-bed STR earns roughly €2,900 versus €775 LTR, and a 2-bed pulls in €2,850 compared to €850. With property prices lower on the island, the cash-flow uplift looks outrageous.

Le Nord sits somewhere in the middle. A 2-bed STR averages €2,250, against €1,200 for an LTR. It’s a healthy premium, though less explosive than Gozo or Central.

En Sliema/St Julian’s, STRs perform well on paper — a 2-bed clears €2,700 vs €1,400 LTR, and a 3-bed pushes €3,200. But the region’s high property costs take the shine off those numbers.

Le South is steady rather than spectacular. A 2-bed STR earns about €2,100 compared to €1,200 LTR, while 3-beds sit at €2,000 vs €1,200. The margins here are narrower than elsewhere.

Overall, STRs consistently outpace LTRs in monthly income, but the size of the advantage varies sharply by location — with Gozo the clear runaway winner.

Marché immobilier de Malte 2025 : Les rendements sous pression

Malta Nationwide

Back in early 2020, AirDNA recorded roughly 11,330 active Airbnb rental listings across Malta, dipping slightly to 10,236 by June 2020 during the pandemic. That shows just how massive the STR pool is compared to the 261 properties in our sample — and it’s likely recovered or even surpassed those levels post-COVID.

Le Central region towers over the rest of Malta’s STR market. AirDNA shows over 1,800 active listings just from Valletta, Gżira, and Msida combined — with Valletta contributing 633, Gżira 1,191et Msida 62. Occupancy is strong too, ranging from about 66% in Msida à 85% in Valletta, meaning the central harbour area is both crowded and lucrative.

By comparison, the Sliema/St Julian’s cluster looks heavy on supply but not quite as vast. . That sheer density explains why yields in Sliema/St Julian’s trail Central: there’s simply more competition for each guest.

Le Nord offers a more balanced mix, with family-friendly two-beds particularly common in St Paul’s Bay, Mellieħa, and Bugibba. It doesn’t reach the volume of Central, but has enough supply to sustain a steady mid-market STR segment.

Le South is relatively modest in scale. With fewer tourist towns, the region doesn’t produce the blockbuster listing numbers of Central or Sliema, but its diversity across unit sizes makes it a steady if unspectacular part of the STR landscape.

And then there’s Gozo, a tiny pool in absolute terms, but one that consistently outperforms on yield. Low supply meets robust demand from visitors chasing the “island within an island” vibe, which is why even a handful of one- and two-bed listings can deliver eye-popping returns.

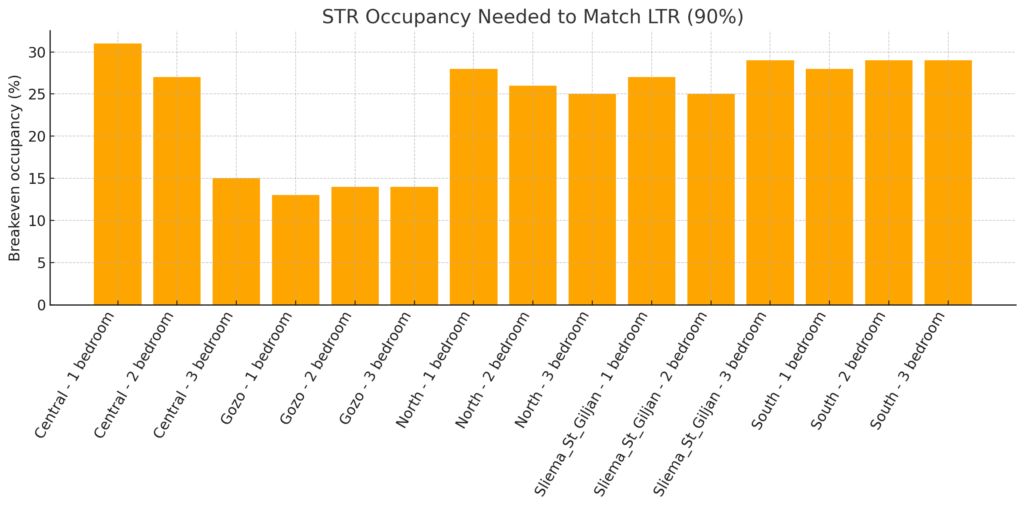

This chart shows how much occupancy a short-let needs to match the returns of a long-let rentals at 90% occupancy.

En Centre de Malte, the results are mixed. A 1-bed STR needs over 31% occupancy to compete with an LTR, while a 3-bed needs only about 15% — far more achievable.

Gozo again stands out. A 1-bed there needs just 13% occupancy to beat a long-let, and even 2-beds are covered at around 14–15%. In other words, a couple of good summer months could carry the entire year.

Le North and South are broadly similar, with most unit sizes requiring 25–29% occupancy to break even. That’s realistic, but it does show how STRs in these regions depend on consistent bookings to stay ahead.

En Sliema/St Julian’s, the bar is higher than you’d expect: most properties need about 25–28% occupancy to keep pace. Given the area’s heavy supply, this makes it a tougher market for new entrants.

Overall, the message is clear: most STRs don’t need to be booked solid to beat a long-let rentals. With breakeven points as low as 13% in Gozo and rarely above 30% anywhere else, the odds are firmly stacked in favour of short-lets — provided you can manage the extra hassle.

Short Term Rentals Win on Yields

For landlords weighing up the choice, the maths is clear: short-term rentals can deliver far higher returns than long-term lets, and at surprisingly low occupancy levels. In many cases, you only need to fill the place a quarter of the time to beat the steady but modest long-let income.

That said, STRs aren’t a free lunch. They come with cleaning bills, utility costs, endless guest questions (“how do I work the remote?”), and a fair bit of hands-on management. Guests also tend to arrive with higher expectations than your average tenant: think fresh linen, fast Wi-Fi, and ideally, weather control.

So while LTRs are the steady plodders – low drama, dependable income – STRs are the flashier cousins: more effort, more upkeep, but also a lot more money in the right locations.