Retirement is a special time, full of new adventures and possibilities waiting to be discovered. And if you’re considering a move abroad, Malta could be just the place for you.

Located within easy reach to Europe, with great weather in all seasons and an English-speaking population, Malta offers a nice mix of calmness and friendliness, exactly what retirees need. From its beautiful scenery and pleasant climate to its interesting history and welcoming communities, this lovely island has something for everyone!

However, there’s more to Malta than the good weather and like-minded people. For that reason, we’re here to uncover everything you need to know about what living in Malta has to offer.

Social Opportunities For International People

Malta has a very interesting and friendly expat scene, with various communities organizing engaging activities like social evenings and other events for international people. Many of these communities are found online, for example on Facebook groups, where expatriates or immigrants living in Malta share their personal experiences, or on websites like Meetup (which can be found on Facebook and Instagram as well) sharing different events expats can join.

Year-Round Mediterranean Climate

In Malta, retirees are greeted with a Mediterranean climate that offers mild winters and warm summers, creating an ideal environment for year-round outdoor activities. During the winter months, the weather remains pleasantly mild, allowing retirees to explore the island’s historic sites or enjoy walks along the coast. As spring transitions into summer, Malta shines with sunny days, inviting retirees to go for a swim, al fresco dining, or simply lounge on golden beaches.

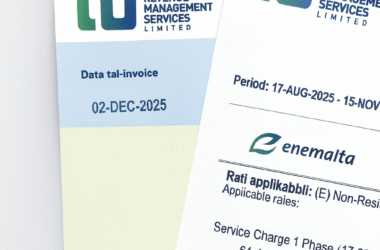

Financial Advantages Include a 15% Tax Rate on All Income

Retiring in Malta comes with some beneficial financial perks. The country imposes a flat 15% tax rate on all income, offering relief to retirees. Furthermore, Malta’s double taxation treaties prevent double taxation on income sourced from other countries. Retirees moving from non-EU countries enjoy customs duty exemptions on personal belongings, while those relocating from within the EU benefit from similar privileges.

For more detailed assistance, kindly refer to the website of Expatax Malta.

Visa-Free Travel to Over 150 Countries

Malta’s Schengen membership allows retirees freedom of movement within the Schengen area. Furthermore, becoming a Maltese citizen grants visa-free travel to numerous countries, including the USA.

Check out the countries‘ Maltese passport holders can travel to visa-free.

Malta exempts residents from succession tax, easing financial burdens on heirs. Retirees need not pay social security contributions, wealth taxes, or property taxes in Malta. However, capital gains tax applies to property sales within three years of ownership, underscoring the importance of financial planning.

Affordable Cost of Living Compared to Other Countries in Europe

While specific expenses may vary depending on lifestyle choices and location within the country, Malta generally offers a reasonable cost of living compared to many European cities. Factors such as affordable healthcare options, exemptions from certain taxes for residents, and a range of available amenities contribute to the overall affordability of life in Malta.

Here’s what to keep in mind:

- While the cost of living is generally lower than in major European cities, popular areas like Saint Julian’s and Sliema can be comparable.

- Rent for apartments ranges from €600 to €1,000 in cities and €600 outside, varying based on location and amenities.

- Healthcare costs are reasonable, with consultations averaging €15 for general practitioners and €40 for dentists.

- Property prices range from €300,000 for a two-bedroom apartment to €350,000 for a small house, with no property taxes for retirees.

Would You Choose Malta as Your Retirement Destination?

Malta appears to be the ideal choice for retirees seeking their dream destination. With its welcoming climate, sunny weather, rich history, and relaxed lifestyle, it truly offers a little something for everyone. And let’s not forget the enticing tax benefits – it’s hard to resist!

For more information regarding relocating to Malta, don’t hesitate to contact us at Expatax.mt to get professional insight and assistance with your move.