Malta’s catering industry is urging action, highlighting that without decisive intervention, labour shortages could undermine the entire sector. Industry leaders are warning that the country could face severe staffing shortages if ongoing recruitment bottlenecks aren’t resolved soon. The takeaway is simple: without third-country nationals (TCNs), Malta’s food service scene could reach breaking point sooner than many realise.

At the Association of Catering Establishments’ Annual Way Forward Conference 2025, held at the San Antonio Hotel & Spa, stakeholders gathered to discuss the future of Malta’s hospitality industry. The path ahead seems to involve smoother systems, faster processing and, most importantly, holding onto the workers who keep Malta’s restaurants, cafés and hotels running.

Catering Sector Tripled in Size While the Workforce Didn’t

Over the past decade the accommodation, food-service and catering segment has grown rapidly. From 2013 to 2023 the “wholesale, retail, transport, accommodation & food” sector added 24,570 jobs filled by third-country nationals accounting for roughly a third of all TCN employment in 2023. Meanwhile, native Maltese employment in that same sector declined by 2,751 over the decade. The Association of Catering Establishments estimates that Malta’s catering sub-sector employs over 30,000 people, representing more than 10% of total employment. Despite this scale, the workforce growth hasn’t kept pace with the sector’s expansion. Add in tourist arrivals that rose 8.1% between 2019 and 2023 and tourist expenditure up more than 20%, and you have a sector that is expanding faster than its labour base.”

Institute of Tourism Studies CEO Pierre Fenech didn’t sugar-coat the reality. With the hospitality sector having tripled in size in recent years, Malta simply does not produce enough graduates to keep up. Even with new ITS campuses planned abroad, the institute’s most optimistic forecast is about 700 graduates a year.

The industry, however, needs roughly 2,000 new workers annually.

As Fenech put it, “The mathematics are what they are,” which is the polite way of saying that TCNs are essential. Full stop.

ACE member and restaurateur Alex Aquilina was even more direct. “If TCNs pulled out, we wouldn’t have an industry. Our sector is labour-intensive.”

This pie chart showing Maltese, EU, and TCN employment distribution in Malta, is based on the latest available figures (NSO, EURES and Jobsplus). TCNs account for 1 in every 4 workers.

Politicians Talk Tough, Perhaps Too Tough, on TCNs

All this is unfolding against a backdrop of increasingly strict government rhetoric on migration. In recent years the government has taken what can only be described as a tough-love approach to TCNs,(although the emphasis has landed firmly on the tough.( Prime Minister Robert Abela has acknowledged publicly that the clampdown on third-country nationals was largely driven by public pressure. The irony, of course, is that the same public still expects the island’s hospitality sector to function seamless when much of this is made possible by TCN workers.

Home Affairs Minister Byron Camilleri has also spoken openly about limiting non-EU nationals and intensifying enforcement, at one point grouping “third-country nationals, landlords and employers” together when discussing lawbreakers. Whether intended or not, the message often cast TCNs as a problem to be controlled rather than the workforce propping up Malta’s economy. Combined with repeated references to Malta’s “tough but fair” return policies, the overall tone has felt less like “welcome aboard” and more like “papers ready, please.”

This narrative sits awkwardly next to the reality highlighted at the conference. Industry leaders were waving red flags, warning that Malta’s catering sector would be in serious difficulty without the very workers being regulated most aggressively. Political messaging seems to have underestimated how vital TCNs are and employers are now facing the consequences.

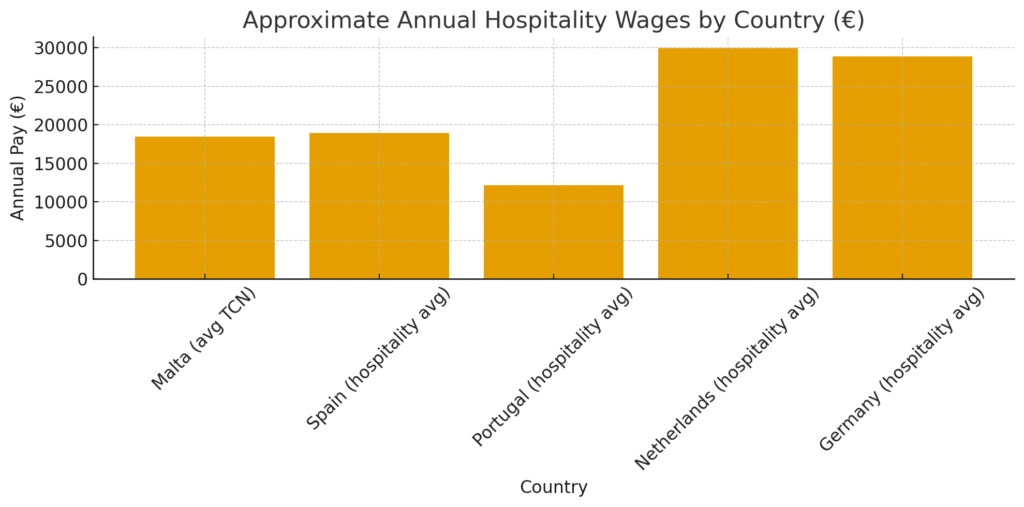

TCN Wage 17 % Wage Gap

Adding to the challenge is the wage disparity that doesn’t help morale or retention. According to a 2024 report by the Justice and Peace Commission, TCNs in Malta had an average basic salary of about €18,443, while Maltese workers averaged €22,912 and EU nationals around €25,319. That’s roughly a 17 % wage gap, despite many TCNs being overqualified for the jobs they’re doing. This kind of pay differential not only undermines fairness but also makes it harder to convince talented non-EU workers that staying in Malta long-term is worth it.

It’s not only domestic issues that concern Malta’s catering industry. Employers warn that third-country nationals have attractive alternatives abroad. In the Netherlands, for example, hotel and restaurant staff earn around €2,300-€2,600 a month, markedly above typical wages in Southern Europe. In Germany, hotel workers average nearly €29,000 a year, well above rates in many Mediterranean markets. For Malta’s employers, already battling recruitment and retention pressures, this means the island isn’t just competing locally, it’s competing with countries offering significantly stronger pay.

In 2024, 16,000 Non-EU Nationals Left Malta

The challenges facing the sector extend beyond recruitment hurdles and wage disparities. A growing number of third-country nationals are also leaving Malta altogether, adding further strain to an already fragile labour market. In 2024 alone, around 16,000 non-EU nationals departed the country, roughly 2,500 more than the previous year. In 2023, the figure was already over 13,500. And while formal enforcement returns remain relatively low — 820 in 2024 — the steady outflow highlights a deeper issue: the sector is struggling not just to attract workers, but to keep them.

According to recruitment expert Daniel Coppini, this situation did not develop overnight. After roughly 15 years of rapid expansion and fragmented regulation, Malta’s labour framework simply reached its limits. “Short-term gains were prioritised over any sort of vision,” he explained, resulting in administrative chaos, loopholes and what he described as “horror stories” involving foreign workers. The Times of Malta reported that TCNs twice as likely to leave a job within the first year; 15% exit within 3 months.

Recent reforms, including tighter rules for temping agencies and measures under the Malta Migration Policy, have helped clean up parts of the system and pushed out many of the “cowboys.” Yet the clean-up has also added new layers of checks, scrutiny and delays, creating a fresh set of obstacles for employers already struggling to retain their workforce.

Identità Delays: Workforce Planning Problems

One issue overshadowed much of the conference: Identità. Employers warned that slow approvals, renewals and ID-card processing are pushing skilled workers to look elsewhere in Europe. Identità representative Andrea Cardona defended the system, arguing that many delays stem from incomplete applications and the extensive due-diligence checks involving JobsPlus, the police and other authorities. Employers accepted that checks are necessary, but stressed that even flawless applications are taking far too long. In one case, a worker reportedly waited over three months after submitting their biometrics.

Phase 2 Skills Pass: 50 % Failure Rate

One reform received widespread praise: the skills pass exam. When it was introduced, the failure rate was nearly 50 percent, highlighting serious skill gaps among applicants. Within months, the rate began to fall, likely because unprepared candidates stopped applying. More than 5,000 non-EU workers now hold the skills pass.

It’s not just cost and delay that are making life harder for non-EU workers. The Skills Pass process itself is proving selective: when it debuted the second-phase interview had roughly a 50 % failure rate. More recent data suggest a modest improvement failure rate of 47 %, but that still means nearly one in two applicants in Phase 2 are turned away. Industry operators say this is a real barrier to staffing in a sector that already says it can’t find enough workers.

Aquilina shared that he lost a promising chef who did not pass the exam but still supports the measure. He described it as necessary but in need of fine-tuning to prevent unnecessary delays.

Le passeport de compétences de Malte : Garantir la qualité ou la complexité ?

Skill Pass Fees Reach €475

Another issue raised (quietly but just as seriously) was the cost of the Skills Pass itself. For many third-country nationals, the fee can reach €475, which is hardly pocket change for workers already earning significantly less than their Maltese and EU counterparts. And while the intention behind the Skills Pass is to improve quality and ensure basic standards, the fact that the requirement currently applies only to non-EU workers has been widely criticised as unfair. Maltese and EU nationals working in the same sector will not need to comply with the same obligation until at least 2027, which leaves TCNs asking why they must shoulder both the higher financial burden and the stricter requirements. In a sector struggling to attract staff, policies that place unequal expectations on the very workers keeping the industry alive risk doing more harm than good.

Retention, Respect and the Baby Shortage Problem

Beyond recruitment, panelists stressed that long-term sustainability depends on how workers are treated. “Our people are the soul of our business,” Aquilina said. “We need to respect them, treat them well and pay them well.”

When asked if Malta could ever rely more heavily on its own population to fill the labour gap, the panel was unanimous: demographic reality says no. Coppini famously summarised it as, “Basically, we don’t make enough babies.” Fenech agreed, noting that Malta’s strong economy offers young locals many appealing job options outside hospitality.

Malta’s Catering Industry Needs TCNs

Malta’s catering industry is thriving, but thriving industries need people. The reality is that Malta cannot operate its restaurants, cafés, bars, hotels or take-aways without foreign workers. While government policy has focused on control and enforcement, industry leaders are clear. Unless recruitment systems become faster, clearer and more predictable, and unless workers are treated more fairly and remunerated more equitably, the sector risks losing the very people who keep it functioning.

Customers may tolerate a slow dessert. What they will not accept is a table with no one there to take their order.