Malta’s Budget 2026, presented on 27 October 2025 under the theme “A Stronger Economy, a Future for Our Children,” shows a government focused on protecting the country’s social model while keeping the economy growing. It takes a steady and practical approach, built around the needs of people and aimed at maintaining stability, easing pressure on households, and supporting those who work, invest, and contribute to the country’s future.

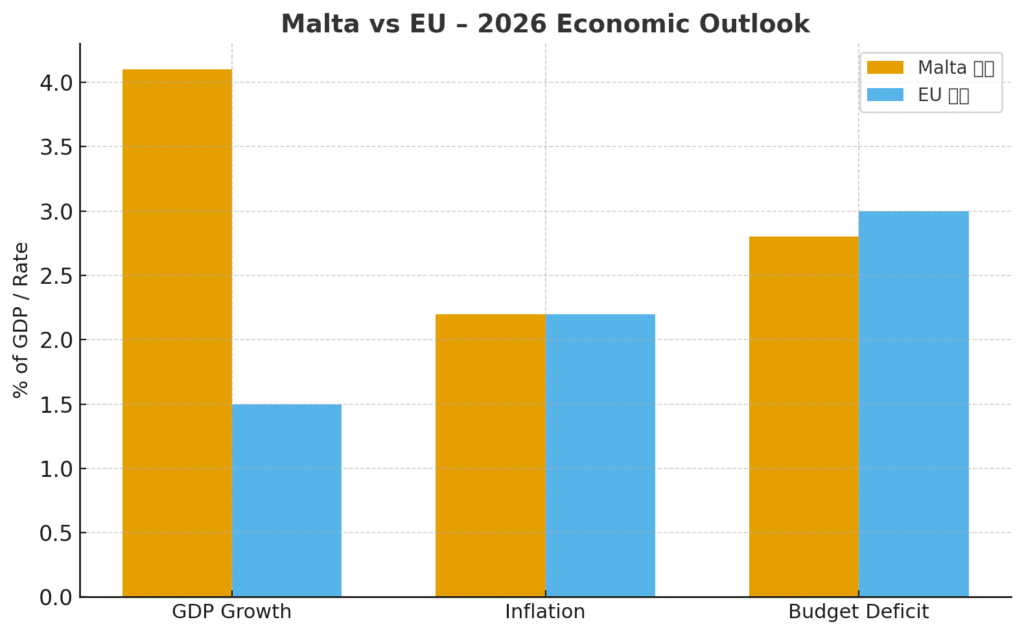

The government expects the economy to grow by 4.1 percent next year, with inflation falling to 2.2 percent and the deficit narrowing to 2.8 percent of GDP. These figures suggest a gradual move toward stronger public finances while keeping enough flexibility to support social and economic goals.

Here’s how Malta’s 2026 budget figures compare with the broader European Commission/Eurostat benchmarks for the EU:

Families and Pensions at the Centre

Budget 2026 continues to prioritise families and pensioners, focusing on real support that strenghtense day-to-day living. From higher pensions and children’s allowances to new education grants and farier tax treshfolds, the measures reflect Malta’s effort to protect households and maintain stability. The main updates are shown below.

| Group / Measure | New Amount (2026) | Previous or “Before” Amount |

|---|---|---|

| Cost-of-Living Adjustment (CoLA) for wage earners | €4.66 per week | ~ “less than €5” — previous years were higher (e.g., ~€5.24/week) (The Malta Independent) |

| Pensions increase | “Hefty increase” announced; basic figure reported as + €10 per week for pensioners | Prior year increases were higher for CoLA/pensions in earlier budgets. |

| Children’s Allowance increase | Increase of €417 per child per year for families earning under ~€23,000 | Previous allowance was lower; for example summary says “Increase of €250 for couples earning less than €30,000. |

| Tax-free thresholds / new tax bands for families with children | New “parent” / “married” tax bands introduced: e.g., for married with one child: 0% tax rate on income up to €17,500 in 2026. | Previous bands did not include differentiated “parent / married with children” rates in exactly this way. |

| Pensioners income-tax exemption | From next year all pensioners will become fully exempt from income tax (i.e., 100% exempt) | Previously: exemption was 80% for 2025 basis. |

| Allowance for post-secondary students / digital support grant | For students in Years 10 & 11: €500 digital support grant. For children in post-secondary: additional €500 per child. | Previous year amounts are not clearly listed in the summary I found. |

🧾 Key Takeaways

- Budget 2026 signals a shift toward consolidation rather than expansion, offering stability but few bold moves.

- Increases for families and pensioners are welcome, yet the overall adjustments remain modest, reflecting a cautious approach in slower economic times.

- The new tax structure is a step in the right direction, though many households may feel that relief still lags behind the real cost of living.

Overview of the Tax Rates

Check the updated tax brackets below to see how the budget 2026–2028 adjustments apply to parents and families across different income levels.

Married rates with one child

| Tax rate | 2026 income (€) | 2027 income (€) | 2028 income (€) |

|---|---|---|---|

| 0% | 0–17,500 | 0–20,000 | 0–22,500 |

| 15% | 17,501–26,500 | 20,001–30,000 | 22,501–33,500 |

| 25% | 26,501–60,000 | 30,001–60,000 | 33,501–60,000 |

| 35% | 60,001+ | 60,001+ | 60,001+ |

🧾 Key Takeaways

- The tax-free threshold rises by €2,500 in 2026, offering more breathing room for lower-income families.

- Middle-income earners benefit from wider bands before reaching higher rates, slightly reducing their effective tax rate.

- By 2028, the 0% band will have expanded by €7,500 since 2025 — a gradual but meaningful easing of household tax pressure.

Married rates with two or more children

| Tax rate | 2026 income (€) | 2027 income (€) | 2028 income (€) |

|---|---|---|---|

| 0% | 0–22,500 | 0–30,000 | 0–37,000 |

| 15% | 22,501–32,000 | 30,001–41,000 | 37,001–50,000 |

| 25% | 32,001–60,000 | 41,001–60,000 | 50,001–60,000 |

| 35% | 60,001+ | 60,001+ | 60,001+ |

🧾 Key Takeaways

- By 2028, these households will enjoy a €7,500 larger tax-free allowance compared to 2025, aligning with the government’s goal of easing the cost burden on working families.

- Families with two or more children gain an additional €2,500 in tax-free income in 2026 compared to 2025.

- The 15% tax band also expands, meaning more of a family’s income remains in lower brackets before hitting higher rates.

Parent rates with one child

| Tax rate | 2026 income (€) | 2027 income (€) | 2028 income (€) |

|---|---|---|---|

| 0% | 0–14,500 | 0–16,000 | 0–18,000 |

| 15% | 14,501–21,000 | 16,001–24,500 | 18,001–28,000 |

| 25% | 21,001–60,000 | 24,501–60,000 | 28,001–60,000 |

| 35% | 60,001+ | 60,001+ | 60,001+ |

🧾 Key Takeaways

- The tax-free threshold for parents rises from €13,000 to €14,500 in 2026 a meaningful €1,500 boost.

- The 15% and 25% bands are widened slightly, lowering effective tax rates for low- and middle-income single parents.

- By 2028, parents will benefit from a €5,000 higher tax-free allowance compared with 2025, giving greater breathing space for working single-parent households.

Parent rates with two or more children

| Tax rate | 2026 income (€) | 2027 income (€) | 2028 income (€) |

|---|---|---|---|

| 0% | 0–18,500 | 0–24,000 | 0–30,000 |

| 15% | 18,501–25,500 | 24,001–33,500 | 30,001–42,000 |

| 25% | 25,501–60,000 | 33,501–60,000 | 42,001–60,000 |

| 35% | 60,001+ | 60,001+ | 60,001+ |

🧾 Key Takeaways

- The tax-free threshold for parents with two or more children incises from €15,000 in 2025 to €18,500 in 2026, giving families an extra €3,500 of income exempt from tax.

- The 15% and 25% bands are winded across all three years, reducing the overall tax burden for middle-income families.

- By 2028, the tax free allowance rises to €30,000, which is €15,000 higher that in 2025, providing significantly more breathing space for working families.

How Malta’s 2026 Budget Keeps Housing Within Reach?

Housing remains one of the government’s top priorities. The first-time buyers’ grant of €10,000, paid over ten years, will stay in place to help people purchasing their first home. The Deposit Payment Scheme has also been widened to include properties worth up to €250,000, making it easier for young adults and new families to get on the property ladder.

The stamp duty reduction on inherited homes has been improved too. The 3.5% rate now applies to the first €400,000 of a property’s value, up from €200,000. This change is meant to make it easier for families to pass homes between generations and keep housing affordable.

Together with ongoing energy and food subsidies, these housing measures show a clear focus on affordability and everyday quality of life, rather than sweeping structural changes.

Business, Employment and Innovation

For businesses, Budget 2026 offers continuity and targeted support rather than sweeping changes.

The popular Micro Invest scheme sees its ceiling increased to €65,000, with Gozo-based enterprises receiving a 20 percent bonus on eligible projects. This ensures small companies continue to benefit from reinvestment and innovation incentives.

A new wage-support incentive will finance 65 percent of salary increases for employees who have worked more than four years with the same company. This aims to reward loyalty, retain skilled workers, and promote sustainable career progression.

Support will be provided to the private sector to boost wages and retain talent:

• For employees with over four years in the same company, 65% of wage increases will be financed for two years, up to €780 per year.

• In Gozo, support rises to 80%, up to €960 per year.

• The maximum Micro Invest benefit will increase from €45,000 to €65,000 in Malta and €80,000 in Gozo to further support small businesses.

Start-ups and SMEs remain a focus area, with continued access to enterprise grants, training funds and digitalisation initiatives, supporting transformation rather than short-term relief.

A Greener, Smarter Malta

Sustainability also features prominently. Budget 2026 introduces fresh grants for electric-vehicle and motorcycle users, alongside €5,000 yearly allowances for individuals under 30 who voluntarily surrender their driving licence, encouraging more sustainable transport habits.

Investment continues in renewable energy and infrastructure upgrades, as Malta moves towards long-term decarbonisation goals. The combination of small-scale incentives and green mobility schemes reflects a strategy of gradual adaptation rather than sudden shifts.

Money in Your Pocket (or not)

Every budget has its winners and its not-so-lucky ones. In 2026, the clear winners are families, pensioners, and students. They get more support for daily costs, a bit more cash in hand, and extra help with education.

Gozo also gets plenty of attention. The government will cover 65% of pay rises in some job sectors, rewarding workers who stay loyal to the same company. It’s a big boost for an island where good jobs can be harder to find.

For others, though, not much changes. Middle-income earners and renters don’t see many new measures. Businesses get stability, not surprises.

It’s a budget built on small wins — a few people get ahead, some stay where they are. Not a headline-grabber, but one that quietly tries to keep life moving and make things a little fairer, one step at a time.